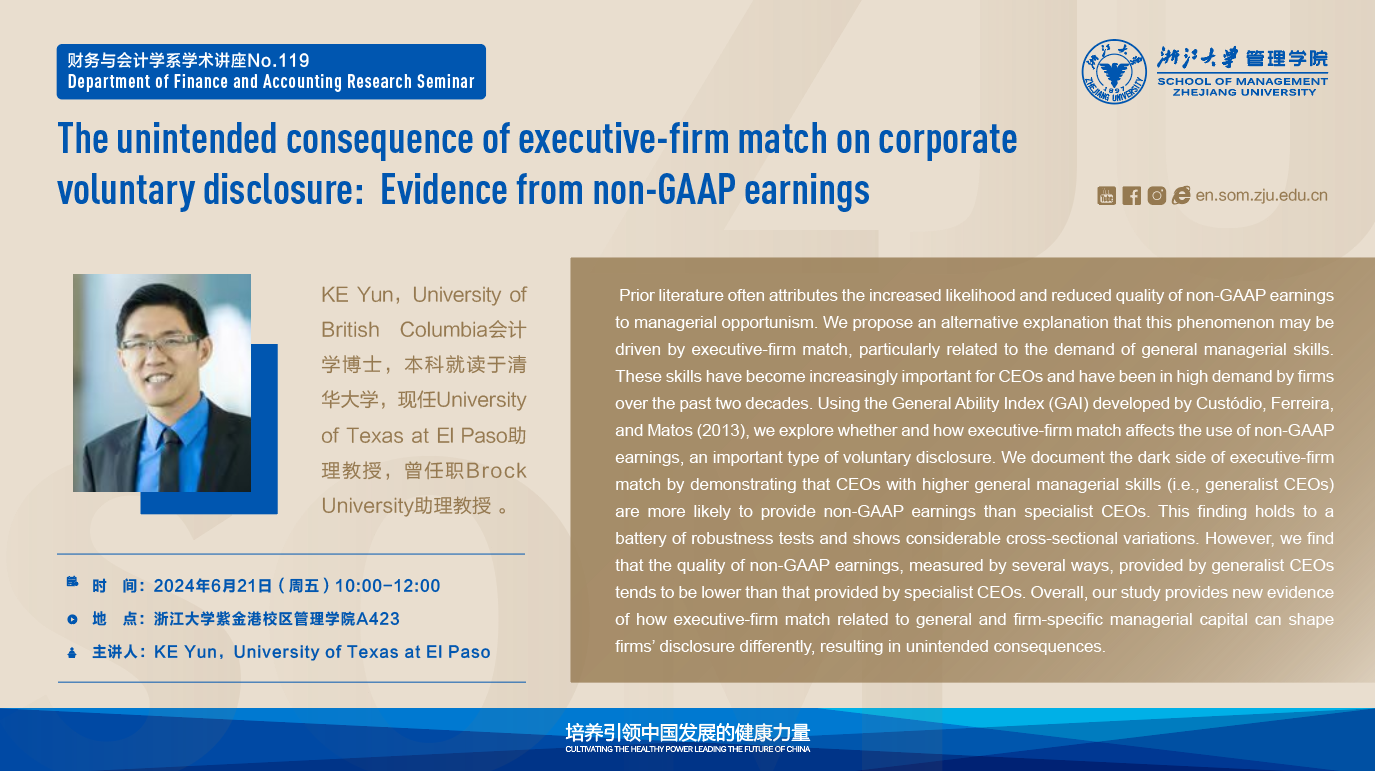

Workshop’s Topic: Prior literature often attributes the increased likelihood and reduced quality of non-GAAP earnings to managerial opportunism. We propose an alternative explanation that this phenomenon may bedriven by executive-firm match, particularly related to the demand of general managerial skills.These skills have become increasingly important for CEOs and have been in high demand by firms over the past two decades. Using the General Ability Index (GAI) developed by Custódio, Ferreira, and Matos (2013), we explore whether and how executive-firm match affects the use of non-GAAP earnings, an important type of voluntary disclosure. We document the dark side of executive-firm match by demonstrating that CEOs with higher general managerial skils (i.e., generalist CEOs) are more likely to provide non-GAAP earnings than specialist CEOs. This finding holds to a battery of robustness tests and shows considerable cross-sectional variations. However, we find that the quality of non-GAAP earnings, measured by several ways, provided by generalist CEOs tends to be lower than that provided by specialist CEOs. Overall, our study provides new evidence of how executive-firm match related to general and firm-specific managerial capital can shape firms’ disclosure differently, resulting in unintended consequences.

Time and Location: 10:00 AM (GMT+8), Room A423 (School of Management)

Language: Bilingual (Chinese and English)