Investments are often fraught with risk. As a result, many people forego opportunities for profit for fear of loss, even if the potential gains are greater than the potential losses.

For example, let us say there is an investment opportunity where you have a 50% chance of winning 15,000 CNY and a 50% chance of losing 10,000 CNY. Would you decide to invest or not?

From the perspective of economic rationality, this investment opportunity has the same probability of winning or losing, but the possible gain amount is greater than the possible loss amount, and the expected return is greater than zero. A rational person should choose to invest.

However, numerous studies have shown that most people would reject an investment opportunity with an expected return greater than zero.

|

Image source: ©千库网 |

The most classic explanation for this phenomenon, which runs counter to the assumption of the rational person in economics, is loss aversion, which states that people tend to avoid losses rather than gain the same amount in profits.

Loss aversion influences people’s decisions in all areas, including investment, consumption, saving, etc. Daniel Kahneman was awarded the Nobel Prize in Economics in 2002 for discovering the widespread phenomenon of loss aversion. However, the internal mechanism of loss aversion remains controversial to this day.

SHENG Feng and WANG Xiaoyi from the School of Management at Zhejiang University and their co-supervised PhD student WANG Ruining, together with Michael L. Platt from the Wharton School at the University of Pennsylvania, have provided a new answer to this question from the perspective of brain research by decoding the brain wave signals of investors.

Click here to access the journal article

|

SHENG Feng | 盛峰 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: SHENG Feng is a researcher and doctoral supervisor at the Hundred Talents Program of Zhejiang University. Research direction: Behavior-based decision making, decision brain research, consumer brain research. You can learn more about Prof. SHENG Feng’s academic background here |

|

WANG Xiaoyi | 王小毅 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: WANG Xiaoyi is a professor and doctoral supervisor at the School of Management, Zhejiang University. Research direction: brain-computer intelligence, consumer neuroscience, new consumption and circular innovation. You can learn more about Prof. WANG Xiaoyi’s academic background here |

|

WANG Ruining | 王睿宁 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: WANG Ruining received her doctorate in business administration (2018) from the School of Management at Zhejiang University. Research direction: consumer psychology and behavior, neuromarketing, etc. |

|

Researchers Observe Decision-Making Tendencies Based on Changes in The Eyes of Investors |

Loss aversion not only affects individual decision-making, but also has implications on a broader social and economic level.

In the world of investing, loss aversion can lead to investors being unwilling to cut their losses when the market falls and instead continuing to hold stocks at a loss in the hope that they will eventually recover.

In consumer behavior, companies use loss aversion to develop advertising strategies. For example, the advertising slogan "On sale today only" capitalizes on customers’ fear of missing out. Customers are more inclined to buy products in order to avoid possible losses.

|

Image source: ©千库网 |

Since loss aversion has such a large impact on our decision making, what is its internal mechanism? How can we understand this psychological activity that still seems to lie in a "black box"? Is it possible to capture this psychological change through external cues such as facial expressions and predict decision-making tendencies?

Back in 2020, SHENG Feng and his colleagues published an article in the Proceedings of the National Academy of Sciences (PNAS) in which they propose a two-dimensional model of loss aversion. The model assumes that loss aversion is not a one-dimensional preference, but can be broken down into two dimensions.

The first is “loss aversion” in appreciation, i.e. when people appreciate the value of investment options, they give more weight to losses than gains. This is the traditional academic understanding of loss aversion.

Another dimension that is often overlooked is the behavioral inertia of "loss avoidance", i.e. once people perceive the risk of a loss, they naturally tend to avoid it. This is people’s behavioral instinct to seek advantage and avoid harm.

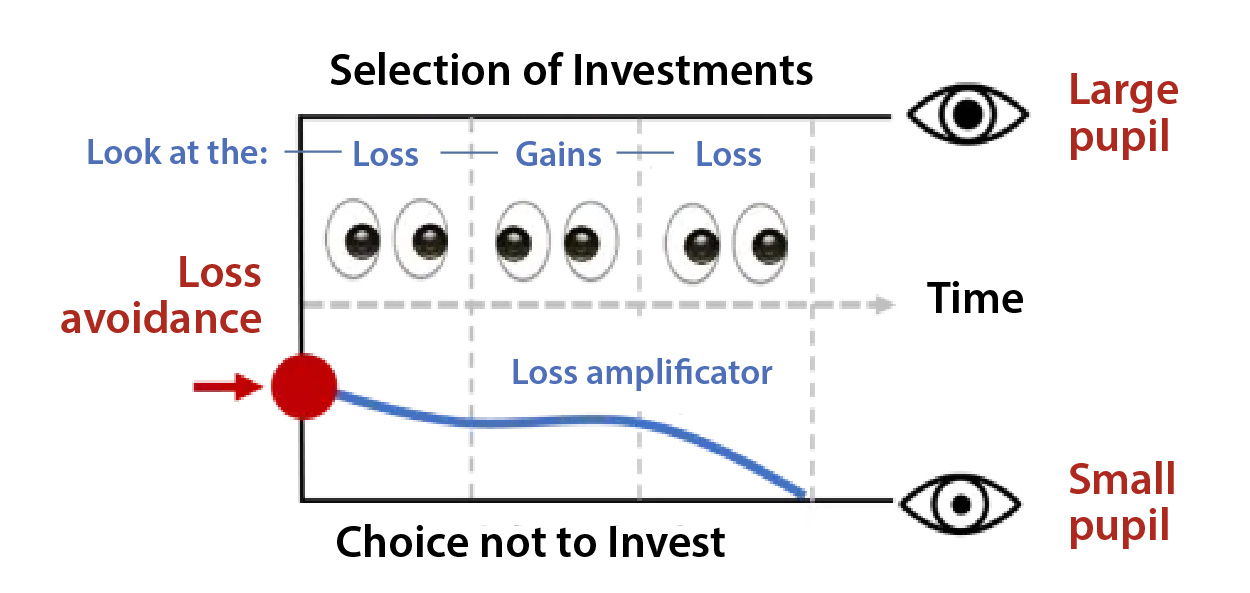

Based on the drift-diffusion model in cognitive computing, researchers proposed a computational model to describe the decision-making process of investment opportunities with a 50 percent chance of winning or losing, and analyzed the dynamic mechanism of loss amplification and loss avoidance on investment decisions.

In addition, they observed investors’ eye movements during the decision-making process using eye trackers and found that different dimensions of loss aversion are reflected in different eye movements when people make investment decisions.

Loss magnification is reflected in the fact that people pay more attention to losses than gains when making investment decisions. Loss avoidance is reflected in the fact that pupils become larger when people overcome their inertia and decide to invest than when they decide not to invest. In other words, the change in an investor’s eyes when they make a decision already indicates their inner decision.

|

Two Dimensions of Loss Aversion Have Different Brain Mechanisms |

Based on the 2020 PNAS study, the team raised a new questions whether the two dimensions of loss aversion have different brain mechanisms?

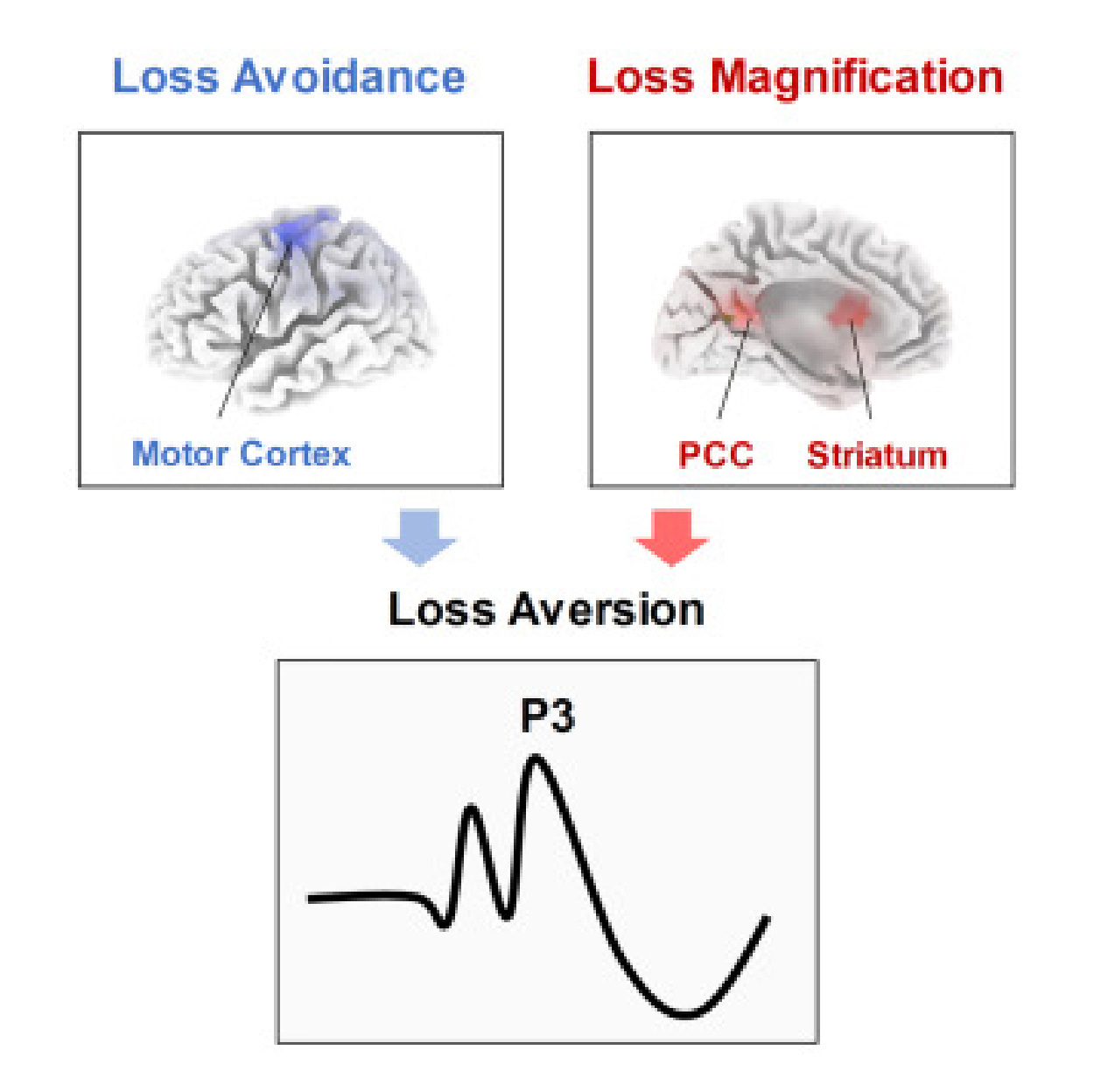

To answer this question, they recorded the brainwave activity of investors as they made decisions and found that both the loss amplification and loss aversion dimensions were associated with a single brainwave component, P3.

The greater the potential gain of an investment option, the greater the P3 volatility, and the greater the potential loss, the lower the P3 volatility. Furthermore, the decrease in P3 volatility when losses become smaller is significantly greater than the increase in P3 volatility when gains become larger, reflecting the amplification of losses.

The greater the P3 volatility, the more likely investors are to invest, while they are more likely not to invest when volatility is lower, reflecting loss aversion. The experimental results show that 73.5% of investors’ investment decisions can be accurately predicted based on the volatility of P3 alone.

In addition, by analyzing the source of the EEG waves, it can be found that the P3 activity related to loss reinforcement can be generated in the reward center of the brain, while the P3 activity related to loss aversion can be generated in the motor cortex of the brain. This shows that the two dimensions of loss aversion have different neurophysiological mechanisms.

|

Based on the Two-Dimensional Framework, They Found That Different Types of Decision-Makers Have Different Brain Waves |

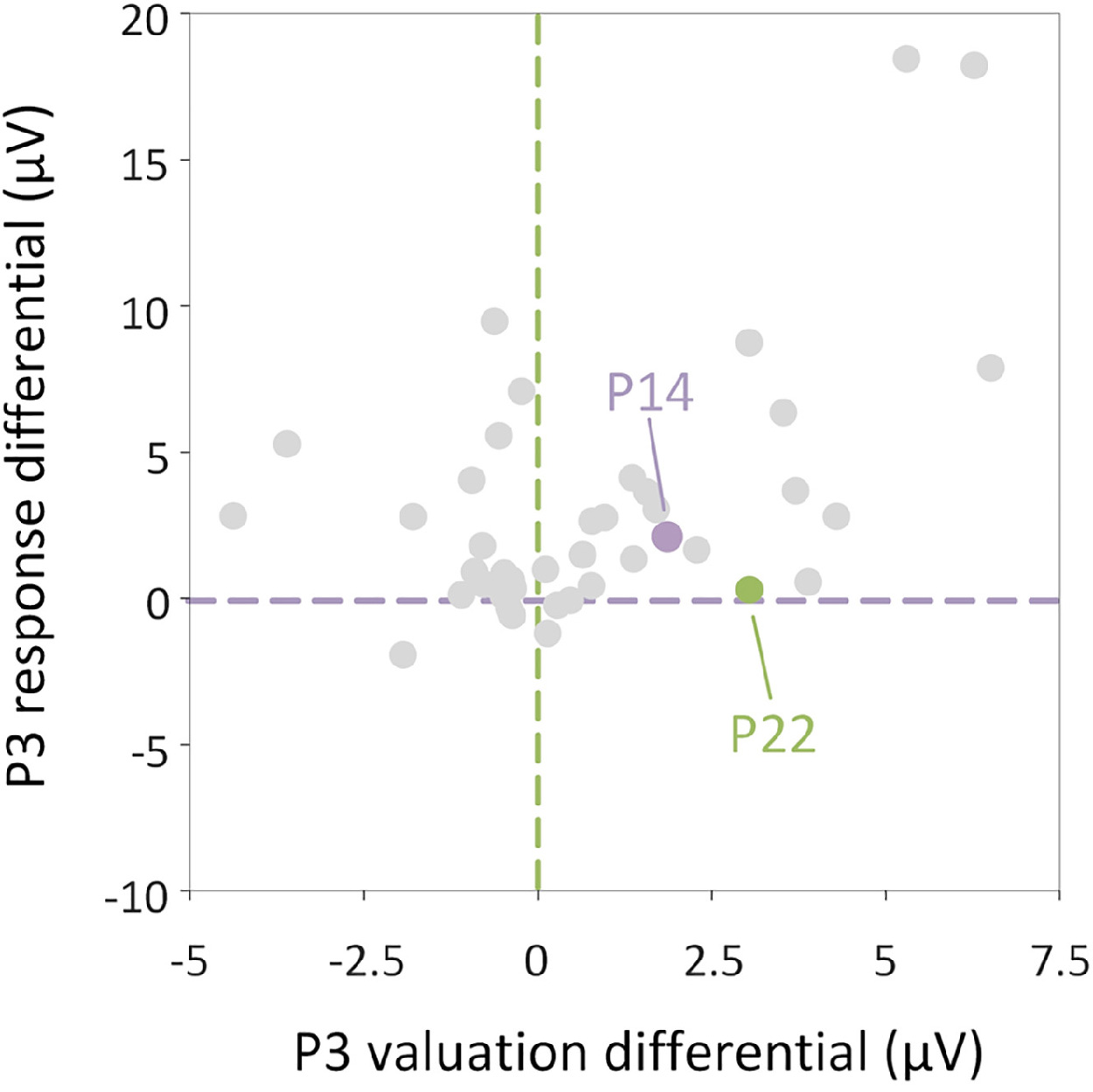

The importance of examining the difference between the two dimensions of loss aversion is that it can be used to identify different types of investors.

For example, within the two-dimensional explanatory framework of loss aversion, an investor with a high degree of loss magnification and a weak tendency to avoid losses and an investor with a low degree of loss magnification and a strong tendency to avoid losses are two completely different individuals.

However, within the traditional one-dimensional explanatory framework of loss aversion, both can be identified as having the same degree of loss aversion.

Furthermore, based on the joint team’s EEG findings, the researchers can directly identify the type of loss aversion of investors based on the pattern of their P3 brain waves.

Figure 5 | Relationship between P3 valuation differential and P3 response differential

For example, if an investor’s P3 brain waves are more sensitive to losses than gains, but insensitive to the decision to invest or not to invest, it can be concluded that he or she is an investor with high loss amplification and low tendency to avoid losses.

Conversely, if an investor’s P3 brainwave is equally sensitive to losses and gains, but more sensitive to investing than to not investing, it can be concluded that he or she is an investor with low loss amplification and a high tendency to avoid losses. This explains the heterogeneity among investors from the perspective of brain research.

Different types of investors have different characteristics and different risk tolerance. Distinguishing their different characteristics can help investors to better understand their investment behavior and market strategies and thus make more informed investment decisions.

|

Using Brain Waves to Identify Different Types of Investors Empowering Investment Behavior and Market Strategies |

The study combines computational modeling, behavioral experiments and brain wave recording to deconstruct the classical phenomenon of "loss aversion" in human investment decisions and provides ample evidence at the behavioral, psychological and neural levels for its causes. The results are of great theoretical and practical importance.

In theory, it provides brain science evidence for the two-dimensional model of loss aversion. Since the researcher SHENG Feng and his collaborators proposed the two-dimensional model of loss aversion in the Proceedings of the National Academy of Sciences in 2020, their views have been cited by well-known scholars at home and abroad, but the relevant evidence has been limited to the behavioral level (including eye movements).

The latest work by the team of SHENG Feng and Wang Xiaoyi deepens the evidence at the level of neural activity and reveals the biological basis of human loss aversion.

In practice, the results of this work show that P3 brain waves can predict people’s investment decisions with an accuracy of 73.5%, revealing the brain wave activity behind investment decisions and giving new momentum to the booming "brain wave" economics.

|

Image source: ©千库网 |

Through this research, we can better understand the thought processes and emotional reactions of people in economic transactions and market behavior and understand the deep mechanisms of economic behavior from a biological perspective.

In addition, the research team also carefully examined the conclusion: If a person’s brainwave activity changes due to the human or natural environment, will their investment decision also change? If so, this offers the possibility of humans interfering with people’s investment decisions, but also poses dangers.

Therefore, further research must carefully consider the social implications of "brainwave" economics and be wary of the harms it may cause when developing its benefits.

|

- We extend our sincere gratitude to researchers SHENG Feng, WANG Xiaoyi, WANG Ruining, and Michael L. Platt for their contributions and insights, advancing our understanding of loss aversion through innovative neural research.

- You can read the original article in Chinese here