The essence of "卷" (juǎn) lies in intense, often self-defeating competition, leading to diminishing returns on investment. The term "卷王" refers to companies that dominate this kind of hyper-competition through aggressive cost and efficiency strategies. "Involution Trap" describes the strategic pitfalls these companies encounter when technological paradigms shift. Chinas manufacturing sector, once hailed as the "worlds factory," benefited greatly from "卷 culture." However, many firms that failed to pivot strategically have fallen into what is now termed the Involution Trap (卷王陷阱).

From the perspective of innovation management, Prof. WU Xiaobo (Distinguished Expert of Zhejiang Province, Professor at ZJUSOM and Director of Zhejiang Universitys Innovation Management and Sustainable Competitiveness Research Center), Ph.D. candidate LIN Fuxin, and M.Sc. student WU Cailingze examine the phenomenon and offer strategic suggestions for sustaining competitiveness.

|

WU Xiaobo | 吴晓波 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: Prof. WU Xiaobo, professor of Innovation and Strategic Management, School of Management, Zhejiang University. He is honored as Chang Jiang Scholar Professor by Ministry of Education, China for his outstanding achievements in innovation and entrepreneurship research and education. He is director of National Institute for Innovation Management and Academy of Global Zhejiang Entrepreneurs, at Zhejiang University. He is also the director of the Zhejiang University—Cambridge University Joint Research Center for Global Manufacturing and Innovation Management and Ruihua Institute for Innovation Management, and was appointed as senior vice president of International Council for Small Business in 2012. He also serves as the vice-president of the Central and East European Management Development Association (CEEMAN). For many years, Prof. WU has been focusing on managing technological innovation and entrepreneurship, global manufacturing and network-based competitive strategy. You can learn more about Prof. WU Xiaobo’s academic background here |

|

LIN Fuxin | 林福鑫 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: Ph.D. Candidate in Technology and Innovation Management, ZJUSOM. |

|

WU Cailingze | 吴蔡灵泽 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: M.Sc. Student in Management Science and Engineering, ZJUSOM. |

|

The Involution Trap in Manufacturing: An Innovation Management Perspective |

|

(Excerpted from Tsinghua Management Review) |

"卷王" (Involution Champion) describes enterprises that leverage management and technological improvements to offer high-quality products at lower costs, with Ford Motor Company as a historical example.

Through assembly line innovations, Ford increased production speed eightfold and dramatically reduced the T-Model’s price, making cars accessible to the masses. By 1921, Ford commanded over 50% of the market.

|

Library of Congress. (ca. 1913). Assembly line at the Ford Motor Companys Highland Park plant [Photograph]. |

The Involution Trap occurs when companies overly focused on cost and process innovation fail to adjust during technological paradigm shifts. Heavy sunk costs in outdated assets and persistent strategic inertia lead to financial decline and loss of competitiveness.

Clearly, far from slowing a company down, anti-involution measures can refresh brand image and generate unexpected positive returns.

|

01 | Understanding the Involution Trap |

The Case of Suntech Power

The solar industry showcases Chinas manufacturing rise — and its risks. Suntech Power, once a sector leader, is a case in point. Starting with module production, Suntech rapidly expanded through innovation and capital operations, achieving global top rankings and listing on the NYSE in 2005.

|

Image source: ©千库网 |

However, reliance on long-term raw material contracts and heavy capital expansion left Suntech vulnerable. As polysilicon prices plummeted (see Figure 1), losses mounted.

|

Figure 1 | Annual Global Polysilicon Average Price and Trend of Suntech Powers Share Price (USD / kg) |

By 2011, Suntech faced over $6 billion in losses and crushing debt. It entered bankruptcy proceedings in 2013 and collapsed in 2014.

Innovation management missteps included:

■ Misjudging technology trends by over-investing in low-efficiency thin-film technology.

Suntech’s downfall illustrates the Involution Trap, emphasizing cost at the expense of strategic adaptability and innovation.

|

02 | Technology Trajectory Fluidity and the Involution Trap |

Polysilicon leader GCL-Poly initially thrived, but advances like PERC monocrystalline cells quickly shifted the industry, with Longi Green Energy rising to dominance.

This reflects the solar industry’s rapid technology trajectory fluidity.

|

Image source: ©千库网 |

Technology trajectory refers to the evolution of a specific technology path over time. Fluidity denotes how quickly such paths change.

Initially, multiple routes (thin-film, multicrystalline, monocrystalline) competed. Later, PERC innovations significantly boosted monocrystalline efficiency, making it the market leader by 2021.

Figure 2 shows ongoing competition among new technologies like TOPCon, heterojunction, and perovskite solar cells.

|

Figure 2 | Market share changes and trend forecasts of different battery technology routes |

|

|

03 | The Involution Trap from the Perspective of Innovation Dynamics |

Firms trapped in involution typically over-invest in manufacturing efficiency, creating organizational rigidity.

Companies must distinguish between product innovation (developing new functionalities and market solutions) and process innovation (enhancing production efficiency). Both are critical, but they serve different strategic goals.

Automation upgrades primarily represent process innovation aimed at short-term cost reduction, not long-term market leadership.

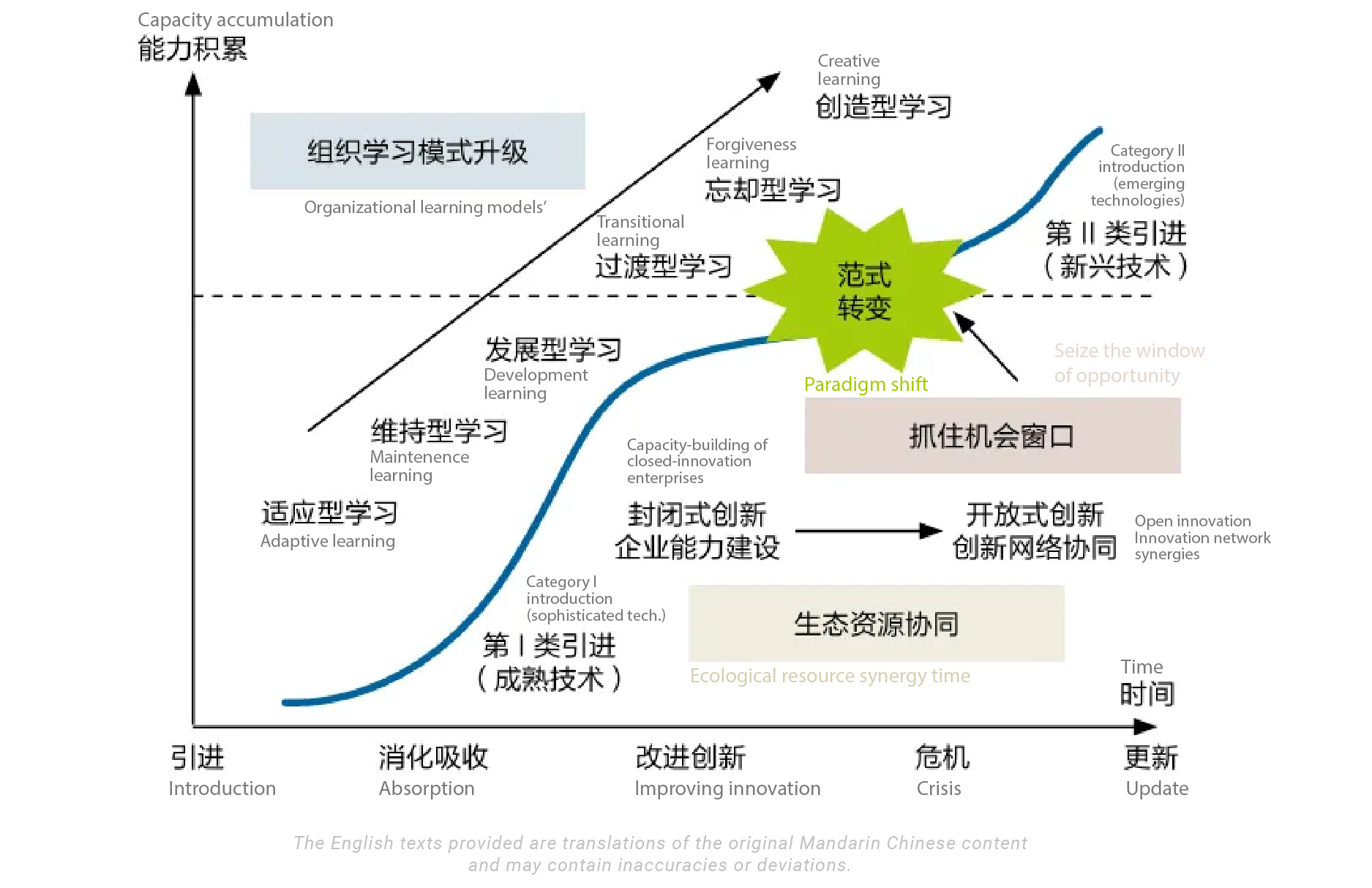

According to the U-A model (Figure 3), early-stage industries prioritize product innovation. As markets mature, process innovation becomes more dominant. Emerging market firms often over-rely on process innovation, risking stagnation without shifting to original innovation.

|

Figure 3 | U-A model and dynamic model of secondary innovation |

Post-reform, many Chinese firms rapidly scaled through cost-focused strategies but struggled to transition toward new technology development, falling into a "catch-up trap."

The "secondary innovation" model emphasizes the need to shift from importing technologies to fostering original innovation for sustainable success.

|

04 | Innovation Management Strategies for Escaping the Involution Trap |

In today’s high-quality development era, systematic reflection on the Involution Trap is crucial. Its root cause lies in insufficient attention to product innovation, especially in industries with high technology trajectory fluidity.

Geely Auto provides a positive example: From launching budget models in 1998 to becoming Chinas largest private car manufacturer by 2017, Geely progressively built its global R&D strength.

|

Figure 4 | U-A Model and Dynamic Model of Decondary Innovation |

Development stages:

■ Pre-2003: Knowledge accumulation through reverse engineering and process improvements.

■ 2004–2008: Investment in proprietary technologies and product innovations like Free Cruiser.

■ Post-2009: Global acquisitions to build a forward-looking R&D network.

■ In 2015, Geely launched the "Blue Geely Action," aggressively transitioning into new energy vehicles by forming innovation ecosystems through investments and partnerships.

■ By 2020, Geely unveiled the SEA architecture for EVs, and its premium brand Zeekr, launched in 2021, quickly gained market recognition.

Prof. WU Xiaobo stresses that escaping the Involution Trap requires "upstream integration", linking industrial chains with innovation networks, particularly by collaborating with universities and research institutions to strengthen innovation sources.

- You can read the original article in Chinese here