Listed companies are the cornerstone of the capital market and an important driving force for the high-quality development of any economy. In recent years, listed companies in China have not only continued to grow in number and size, but have also played an indispensable role in technological innovation and the development of strategic new industries. As China’s requirements for high-quality development continue to increase, the status and role of listed companies have become more important.

Recently, the "2024 China Listed Companies Innovation Index Report" (hereinafter referred to as the "Report") was released and the list of China’s top 500 listed companies in the innovation index was announced. The Report was compiled by GUO Bin, Director of the Department of Innovation, Entrepreneurship and Strategy of the School of Management of Zhejiang University, and jointly published by the School of Management of Zhejiang University, the National Innovation Base of Philosophy and Social Sciences for Innovation Management and Sustainable Competitiveness Research of Zhejiang University and the Zhejiang University Global Zhejiang Business Research Institute.

Since 2015, Professor GUO Bin’s team has compiled and published the "China Listed Company Innovation Index Report" every year based on A-share listed companies.

|

This year is the tenth year of the "Innovation Index Report" research series published by GUO Bin’s team |

|

GUO Bin | 郭斌 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: Professor and doctoral supervisor at the Department of Innovation, Entrepreneurship and Strategy, School of Management, Zhejiang University Research area: Innovation management and strategy. You can learn more about Prof. GUO Bin’s academic background here |

|

Report Findings |

The report selected Chinese A-share listed companies as valuation objects (note: excluding Hong Kong, Macau, and Taiwan), with 4,022 listed companies as the sample. The Main Stock Exchange, the Small and Medium Enterprise Stock Exchange, and ChiNext are all included, covering industries such as manufacturing, information transmission, software and information technology services, scientific research, and technical services, comprising four major categories and 36 secondary sub-industries.

To objectively evaluate the innovation performance of Chinese enterprises, the survey team has formed two dimensions: Innovation strength and innovation efficiency, based on the scale of R&D investment of sample enterprises, the scale of scientific research personnel, patent scale data, average return on sales and indicators of R&D intensity, technological efficiency, and business model novelty.

|

Image source: ©千库网 |

In addition to the rankings, the report is divided into nine chapters, including the construction method of the innovation index, the analysis of cities and provinces, the analysis of digital focus, the analysis of domestic substitution focus, and the impact of innovation on business resilience. By objectively evaluating the innovation level of listed companies, it aims to provide guidance for enterprises to formulate innovation strategies.

|

■ |

More than half of the top 500 companies are concentrated in nine cities |

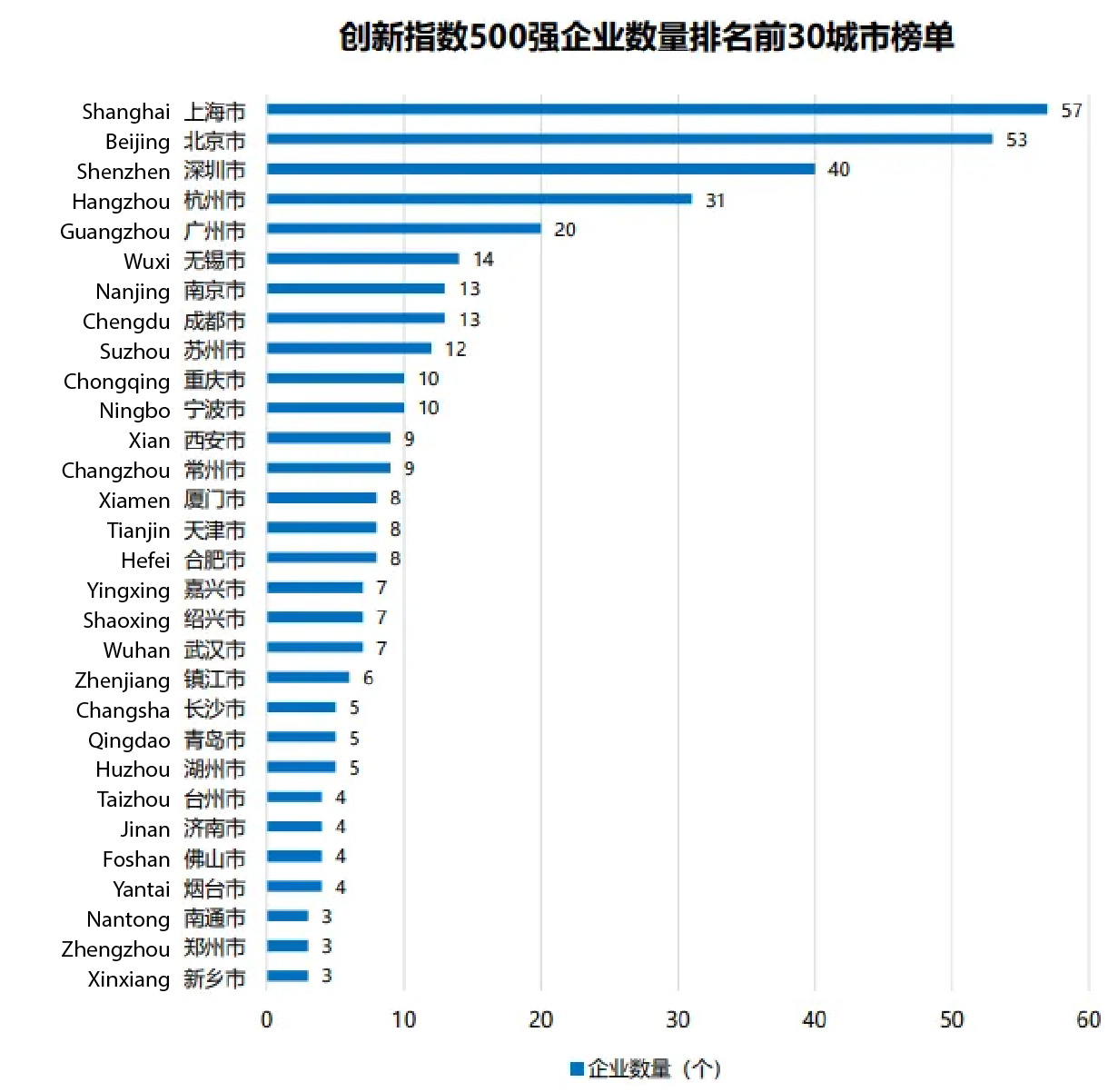

Innovative enterprises are concentrated in economically developed coastal cities and provincial capitals. The report shows that the 2023 Innovation Index Top 500 list includes 253 companies from nine cities: Shanghai (57), Beijing (53), Shenzhen (40), Hangzhou (31), Guangzhou (20), Wuxi (14), Nanjing (13), Chengdu (13) and Suzhou (12).

Compared to last year, Shanghai has overtaken Beijing and is now the city with the most companies in the Top 500 Innovation Index. The list of the top five cities remained unchanged from last year. Chongqing and Ningbo replaced Tianjin as the cities with 10 top 500 innovation index companies.

Figure 3-1 | Innovation index - Top 30 Enterprise Cities

|

■ |

Guangdong has the most companies on the list; Companies in each province have local characteristics |

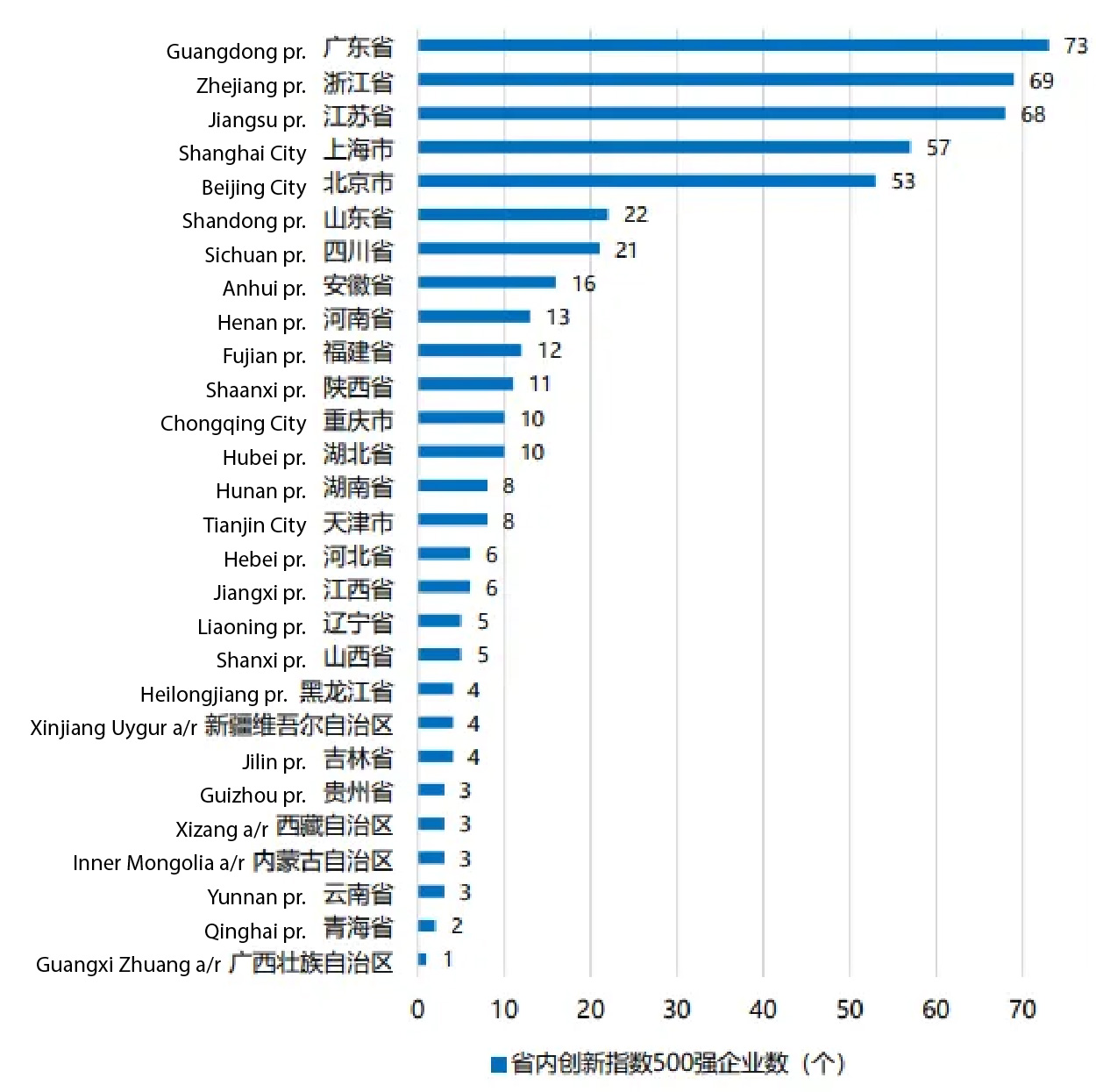

Guangdong, Zhejiang and Jiangsu occupy the top three places in the provincial distribution ranking, underlining the central position of the Yangtze River Delta and Pearl River Delta regions in China’s innovation landscape. These companies are mainly located in Guangdong (73 companies), Zhejiang (69 companies), Jiangsu (68 companies), Shanghai (57 companies) and Beijing (53 companies).

Figure 4-1 | Company distribution in provinces | Top 500 Innovation Index

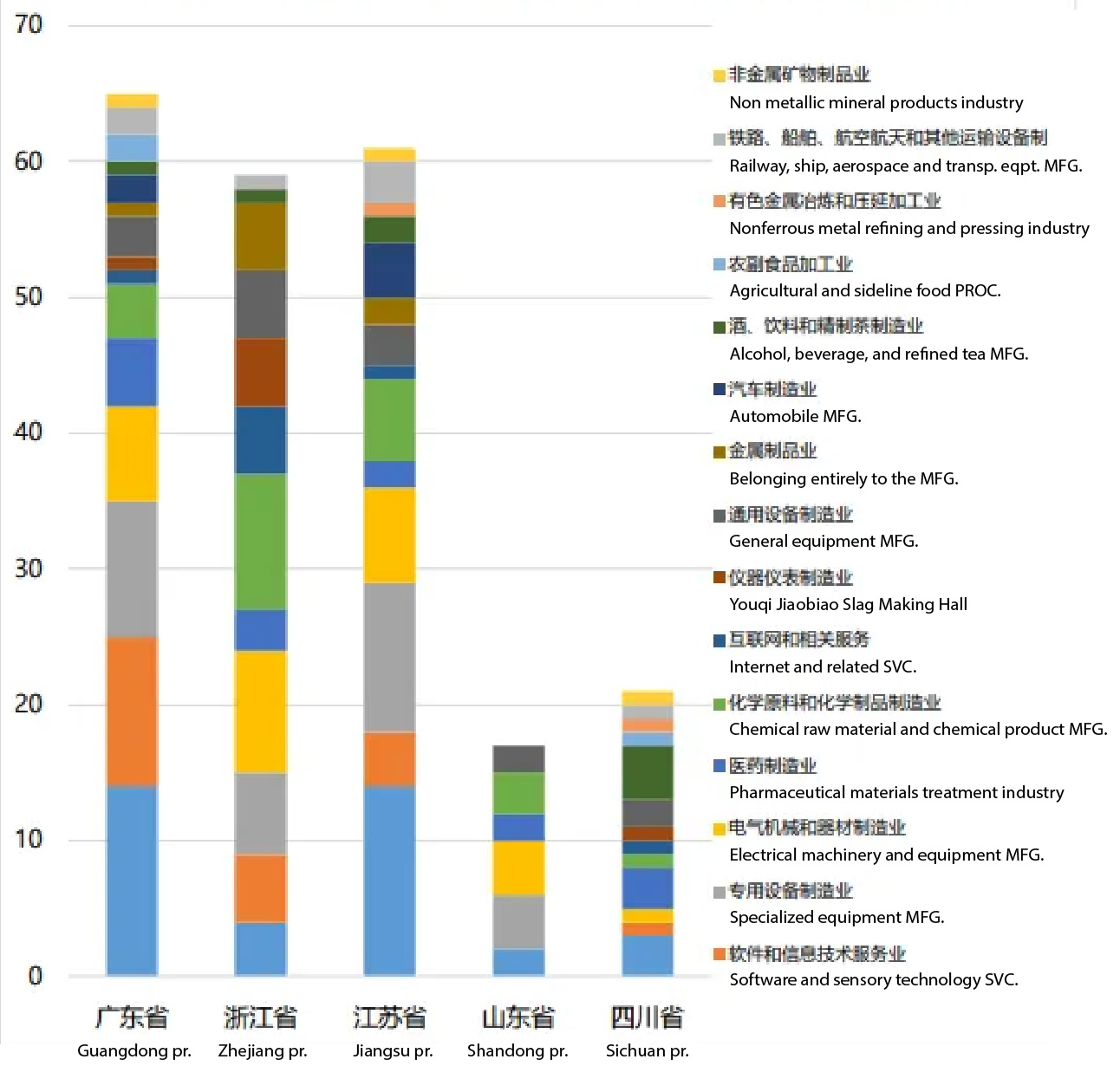

It is worth noting that the industry distribution of the top 500 innovation index companies in Guangdong, Zhejiang, Jiangsu, Shandong, and Sichuan shows that the industries to which the listed companies in each province belong have certain local characteristics. For example, Guangdong province has an outstanding performance in the manufacturing of computers, communications and other electronic equipment, and the number of companies in the software and information technology services industry is also significantly higher than in other provinces and cities.

The industry with the most listed companies in Zhejiang Province is the manufacture of chemical raw materials and chemical products, while the manufacture of electrical machinery and equipment and the Internet and related services industry also occupies an important position.

Figure 4-2 | Industries with the top 500 companies in the innovation index of the top five provinces

Jiangsu Province has outstanding achievements in the manufacture of computers, communications equipment, and other electronic devices, as well as in the manufacture of specialized equipment, and also has a large number of listed companies in the automotive industry.

The listed companies in Shandong Province mainly focus on the production of special equipment and the manufacture of electrical machinery and equipment. The production of chemical raw materials and products and the pharmaceutical industry also have some innovative achievements.

Most listed companies in Sichuan Province focus on the wine and beverage industry and the production of refined tea, and have also shown some innovation in the production of computers, communications equipment, and other electronic devices, as well as in the pharmaceutical industry.

|

Image source: ©千库网 |

|

■ |

The balance between urban innovation efficiency and innovation power must be improved |

The report analyzes 51 cities with at least 15 sample companies. Further analysis shows that the city with the highest number of companies is not necessarily the city with the highest innovation power or efficiency and that a city with a high ranking in innovation power does not necessarily mean that innovation efficiency is high. There is a clear divergence between the excellent performance of the leading companies and the average status of the city. For example, Shenzhen, Shanghai, and Beijing have a large number of enterprises, but their average innovation efficiency is relatively low.

According to the average ranking of innovation power and innovation efficiency, 51 cities are divided into four quadrants, and the scatter chart shows that Zhenjiang, Zhengzhou, Hangzhou, and other cities belong to the cities with high innovation power and high efficiency; Shanghai, Beijing, Suzhou, Yantai, and other cities are cities with low innovation power and high efficiency; Shaoxing, Zhuhai, Jinhua and other cities do not perform well in both indicators; Shenzhen, Guiyang, Dalian and other cities have great advantages in innovation power, but their innovation efficiency needs to be improved.

|

■ |

The higher the ranking, the more attention companies pay to digitalization |

With the continuous emergence of digital technologies such as artificial intelligence, blockchain, cloud computing, big data, and the Internet of Things, digitalization is becoming an important breakthrough point for innovation and transformation of global enterprises. In this context, digitalization is not only regarded as the only way for enterprises to achieve high-quality development but also a hot topic that jointly engages the three circles of "government, academia, and industry".

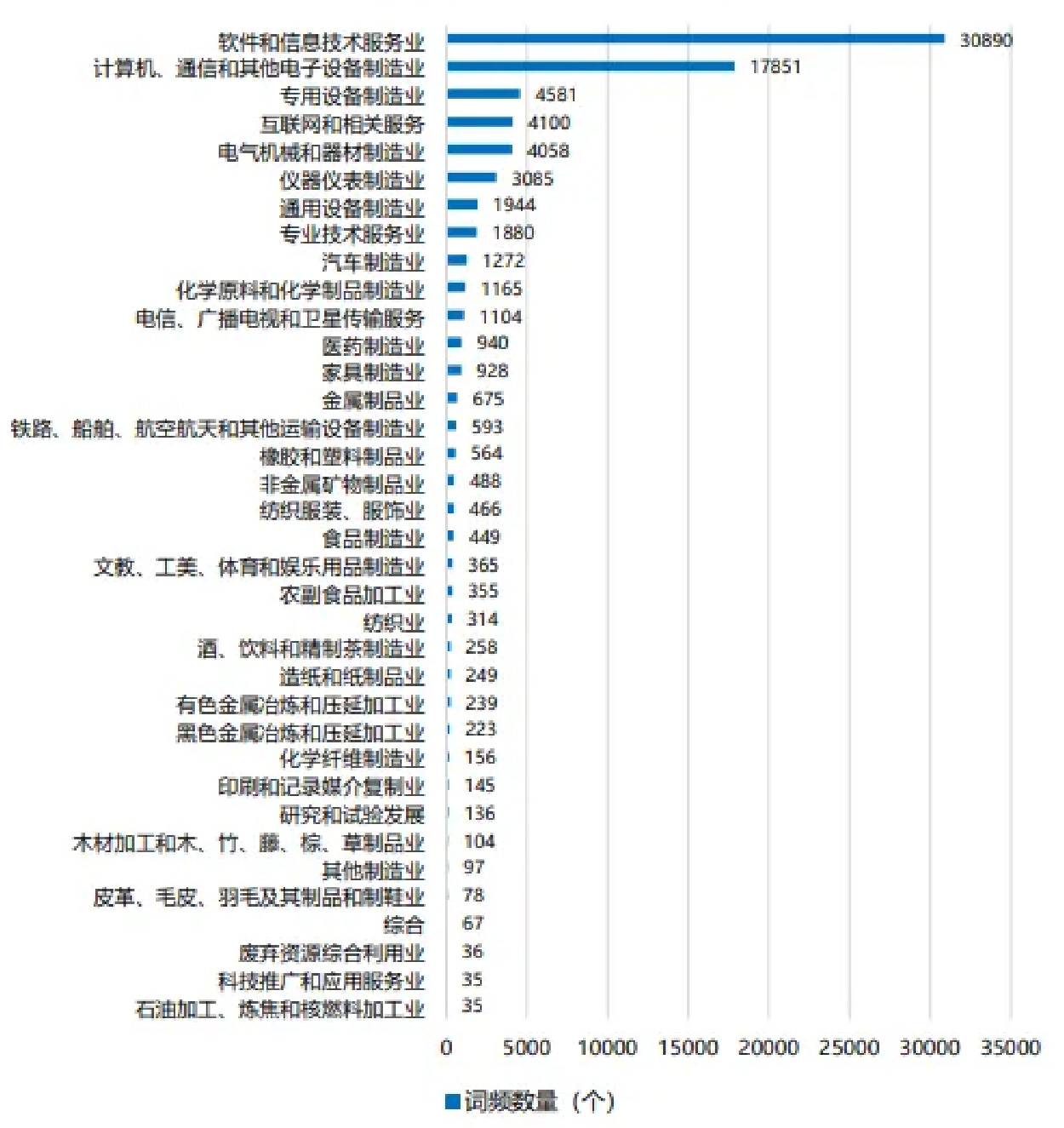

So how is the attention of listed companies to digitalization distributed? The survey and analysis found that core technologies such as artificial intelligence, big data, the Internet of Things, and cloud computing have become the focus of companies’ digitalization strategies, demonstrating the driving role of technological innovation in the future development of enterprises. The companies in the sample that are among the top 500 in the Innovation Index pay great attention to digitalization, and digitalization has become an important part of strategic discussions within companies.

At the same time, there are obvious differences in the degree of emphasis placed on digitalization in the various sectors. High-tech companies are at the forefront of digital transformation, while traditional industries are relatively slow in digital transformation and need to accelerate the pace of digital transformation and improve their efficiency and market competitiveness through the introduction and application of advanced digital technologies.

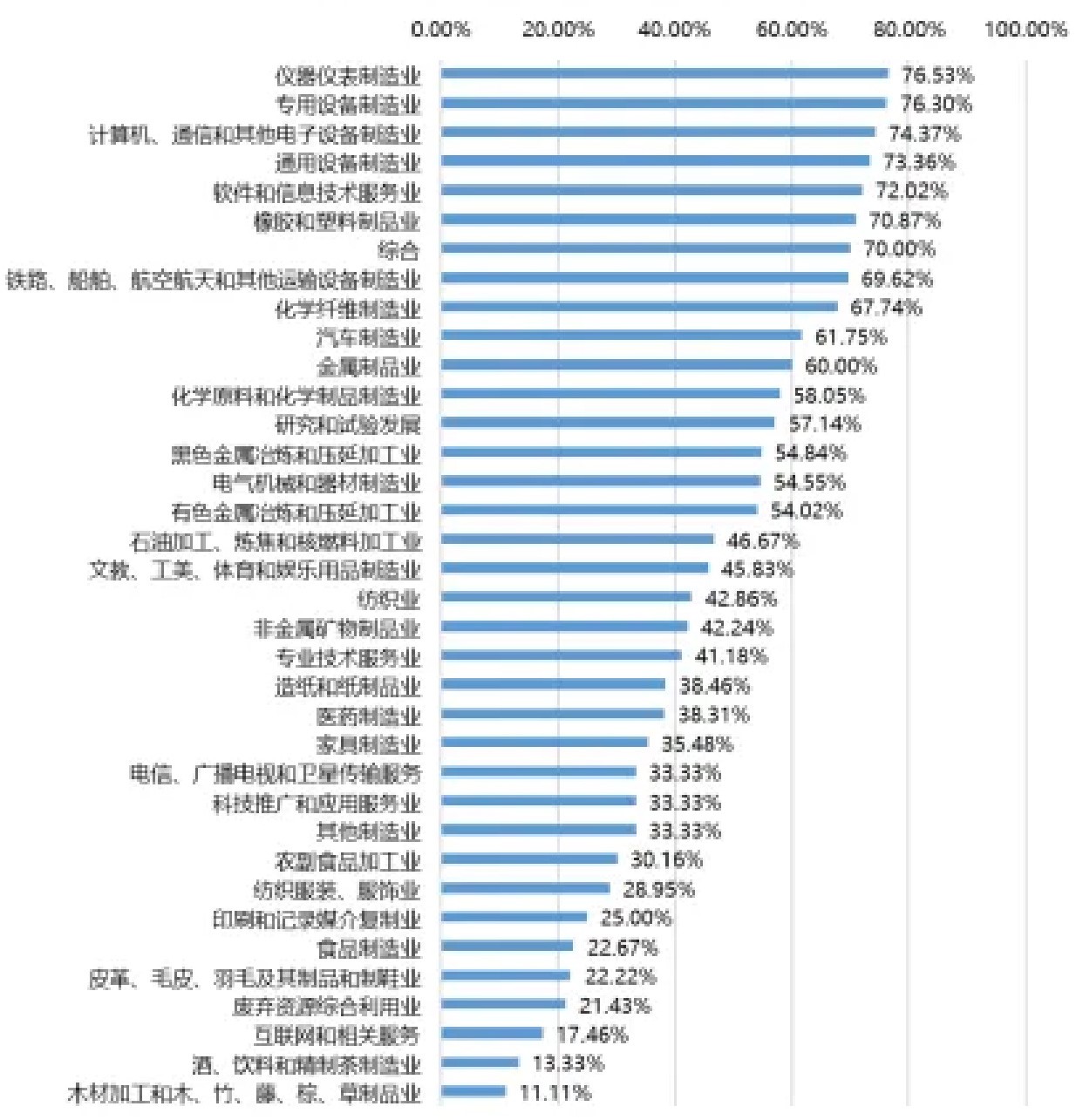

Figure 6-3 | Digital Attention by Industry for the Total Sample of Innovation Index

|

■ |

Domestic substitution is still a new trend in industrial development |

In the process of deglobalization, Chinese enterprises are paying more and more attention to business continuity and supply chain stability, while competition between local enterprises and Western multinationals has made it increasingly difficult and expensive to acquire technology. At the same time, the demand potential in China’s local market is gradually being released as local purchasing power continues to rise. So what is the overall attention of Chinese listed companies to domestic substitution? What types of companies will pay more attention to domestic substitution?

The report found that more than half of the 4,022 listed companies are concerned about domestic substitution in 2023, and nearly 100 companies have expressed great concern. From the perspective of industry distribution, domestic substitution is becoming a trend that many domestic industries are generally concerned about. This is particularly evident in instrument manufacturing, special equipment and computer manufacturing, communication equipment, and other electronic equipment manufacturing, where more than 70% of companies are concerned about domestic substitution.

Figure 7-2 | The Proportion of Enterprises Concerned about Domestic Substitution in Domestic Industries

Compared with last year, the proportion of chemical fiber manufacturers relying on domestic substitution enterprises has increased the most, which may be related to the narrowing of final demand in the chemical fiber industry. According to the China Chemical Fiber Industry Association, the Chinese textile industry’s export pressure will increase in 2023 due to trade barriers, and the total export volume of textiles and garments will decrease by 8.1% year-on-year.

It is worth noting that the attention to domestic substitution shows significant industry differences. The upstream and technology-intensive manufacturing industries have a higher level of attention, and there is attention in both the manufacturing and service sectors. As shown in the table above, attention to domestic substitution is relatively high in technology-intensive industries such as instrumentation, special/general equipment, computers, and communications. Most of these industries are upstream of the supply chain and support the development of other manufacturing industries. In addition, in the services industry, attention to domestic substitution in software and information technology is relatively high.

|

Image source: ©千库网 |

|

“ |

The innovation-driven characteristics of Chinese enterprises are becoming more prominent, but there are still great differences between enterprises at the industry and regional levels, and the balance between innovation strength and innovation efficiency needs to be improved. Secondly, Chinese enterprises still need to pay close attention to how to better and more efficiently transform their innovation capability into actual business value. Moreover, in an era of great change and constant uncertainty, innovation has become a key force to strengthen the resilience of enterprises and achieve sustainable growth. " concludes GUO Bin. |

- We thank Prof. GUO Bin for his work for the 10th consecutive year in collecting and summarizing the information on China’s greatest and most successful innovators and making his findings accessible and easier to understand for the general public.

- You can read the original article in Chinese here