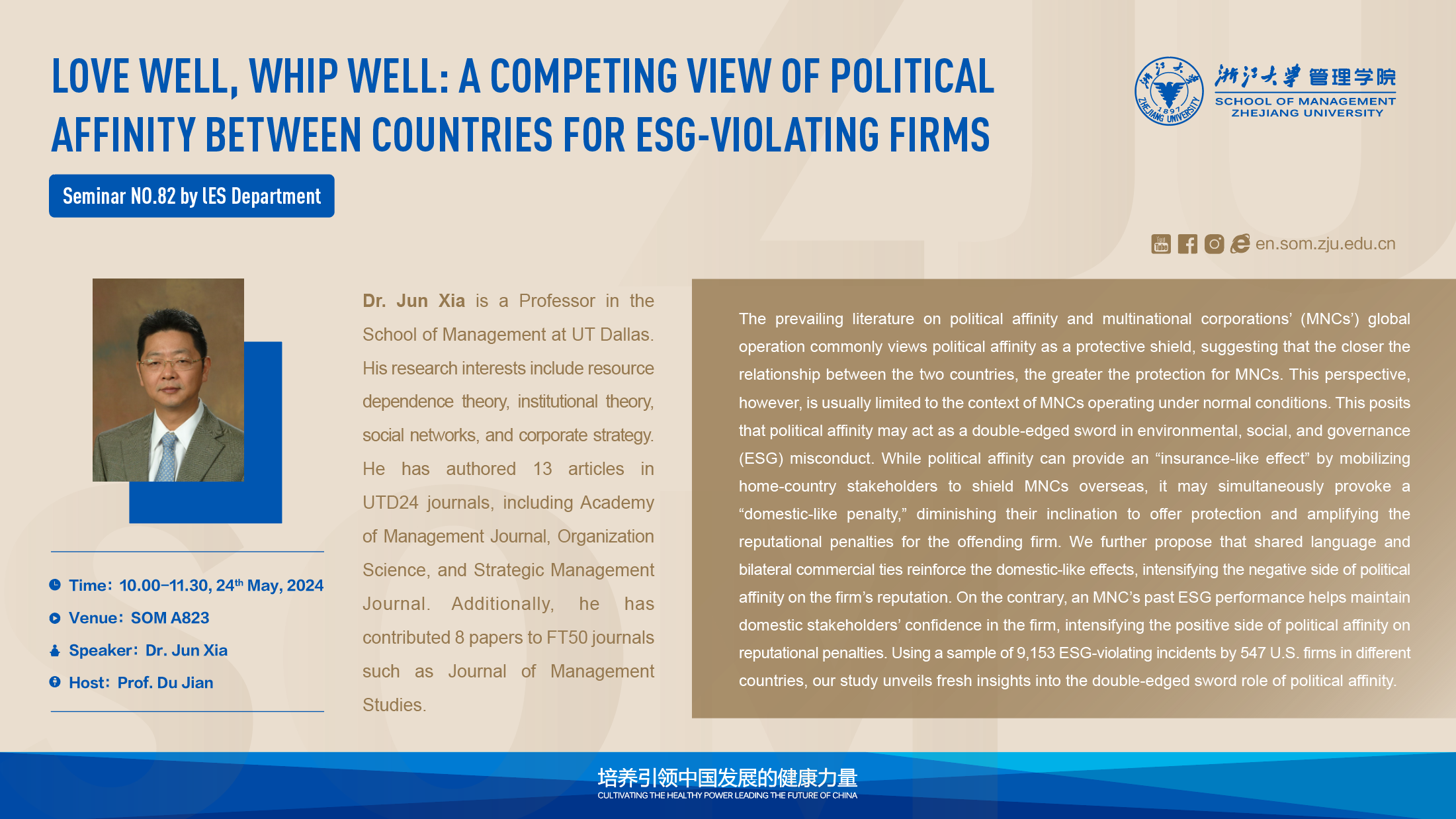

Workshop’s Topic: The prevailing literature on political affinity and multinational corporations’ (MNCs’) global operation commonly views political affinity as a protective shield, suggesting that the closer the relationship between the two countries, the greater the protection for MNCs. This perspective, however, is usually limited to the context of MNCs operating under normal conditions. This posits that political affinity may act as a double-edged sword in environmental, social, and governance (ESG) misconduct. While political affinity can provide an “insurance-like effect” by mobilizing home-country stakeholders to shield MNCs overseas, it may simultaneously provoke a “domestic-like penalty," diminishing their inclination to offer protection and amplifying the reputational penalties for the offending firm. We further propose that shared language and bilateral commercial ties reinforce the domestic-like effects, intensifying the negative side of political affinity on the firms reputation. On the contrary, an MNC’s past ESG performance helps maintain domestic stakeholders’ confidence in the firm, intensifying the positive side of political affinity on reputational penalties. Using a sample of 9,153 ESG-violating incidents by 547 U.S. firms in different countries, our study unveils fresh insights into the double-edged sword role of political affinity.

Time and Location: 10:00 AM (GMT+8), Room A823 (School of Management)

Language: Bilingual (Chinese and English)