In the age of information explosion, merchants have been racking their brains and making every effort to attract consumers’ limited attention and close deals. But in reality, their trading volumes are not getting any better. Why so?

|

©千库网 | Qianku Network |

It is often said that trading is an art, as if the success of trading is metaphysics. But in the eyes of scholars, trading is a science with objective laws to follow.

Recently, Feng SHENG, a researcher from Zhejiang University School of Management (ZJUSOM) who has long been deeply involved in cognitive computer science, together with Professor Xiaoyi WANG and other scholars from ZJUSOM, published the article "The art of trading: Deciphering the endowment effect from traders’ eyes" in Science Advances, a comprehensive journal under Science, revealing the secret of "transaction".

|

Click on “Read Original Text” in the lower left corner at the end of the article to read the full text of the research paper. |

In the study, Feng SHENG and his team put forward an attention-based trading theory from the perspective of cognitive computer science and tested this theory in combination with computer modeling, behavioral experiments, and eye-tracking technology to gain new insights into the "endowment effect" and the mechanism of attention in trading.

|

Prof. Feng SHENG presents the results of the study |

|

Feng SHENG | 盛峰 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: Researcher and doctoral supervisor in the Department of Marketing, School of Management, Zhejiang University, and a key member of the National Key Laboratory of Brain-Computer Intelligence. Research areas: Behavior-based decision making, decision brain research, consumer brain research. You can learn more about Dr. Feng SHENG’s academic background here |

|

Xiaoyi WANG | 王小毅 School of Management, Zhejiang University |

||

|

|

||

|

|

|

Academic Background: Professor and doctoral supervisor in ZJUSOM Department of Marketing, ZJUSOM Associate Dean, and Deputy Director of Neuromanagement Laboratory of Zhejiang University. Research directions: Digital intelligence marketing, consumer neuroscience, digitalization of the economy, digital brand, and brand growth. You can learn more about Prof. Xiaoyi WANG’s academic background here |

|

They Introduce the Model of the Decision-Making Process of Transactions and Reveal a New "Insight" Into the Endowment Effect |

It is not easy to close a deal. The deal can fall through because the buyer and seller cannot agree on a price. One of the best-known benefits is the endowment effect.

Feng SHENG explains that the endowment effect refers to the compensation a man demands after giving up an item, which is often higher than the price the man is willing to pay to obtain the item.

That is, in a transaction, the price the seller wants to obtain when selling a good is often higher than the price the buyer is willing to pay when purchasing a good. In other words, the seller’s psychological price for a good is often higher than that of the buyer.

The existence of the endowment effect means that it is difficult to close a deal even if there are no costs involved.

Since the "endowment effect" was proposed by Richard Thaler, the Nobel Prize winner in economics in 1980, it has triggered a large number of follow-up studies and promoted the development of behavioral economics. However, the mechanism underlying the endowment effect is still controversial today.

|

©千库网 | Qianku Network |

|

01 |

Is it greed or laziness that causes a business to fail? |

|

After a systematic review of the literature on the endowment effect, Feng SHENG and his team have identified two mechanisms that lead to the failure of transactions. The first is "greed", i.e., neither buyer nor seller intends to suffer a loss in the transaction. As a result, buyers tend to underestimate the value of goods in transactions, while sellers tend to overestimate the value of goods in transactions. In contrast, the divergence in the subjective valuation of goods by buyers and sellers leads to an endowment effect. The second cause is "laziness", i.e., both buyers and sellers have the inertia not to act. Status quo bias is a natural inertia of people that prevents them from doing things that could change the status quo, such as trading. To overcome this inertia and make a transaction, both buyers and sellers need additional incentives, which manifest themselves in bargaining, i.e., buyers need a discount and sellers a premium, which leads to an endowment effect. Feng SHENG and his team said that previous studies on the mechanism of the endowment effect often focused on greed or laziness separately. But the question is, are buyers and sellers greedy and lazy ? |

|

©千库网 | Qianku Network |

|

02 |

Greed and Laziness Manifest Themselves in Both Trading Decisions and Decision Time |

|

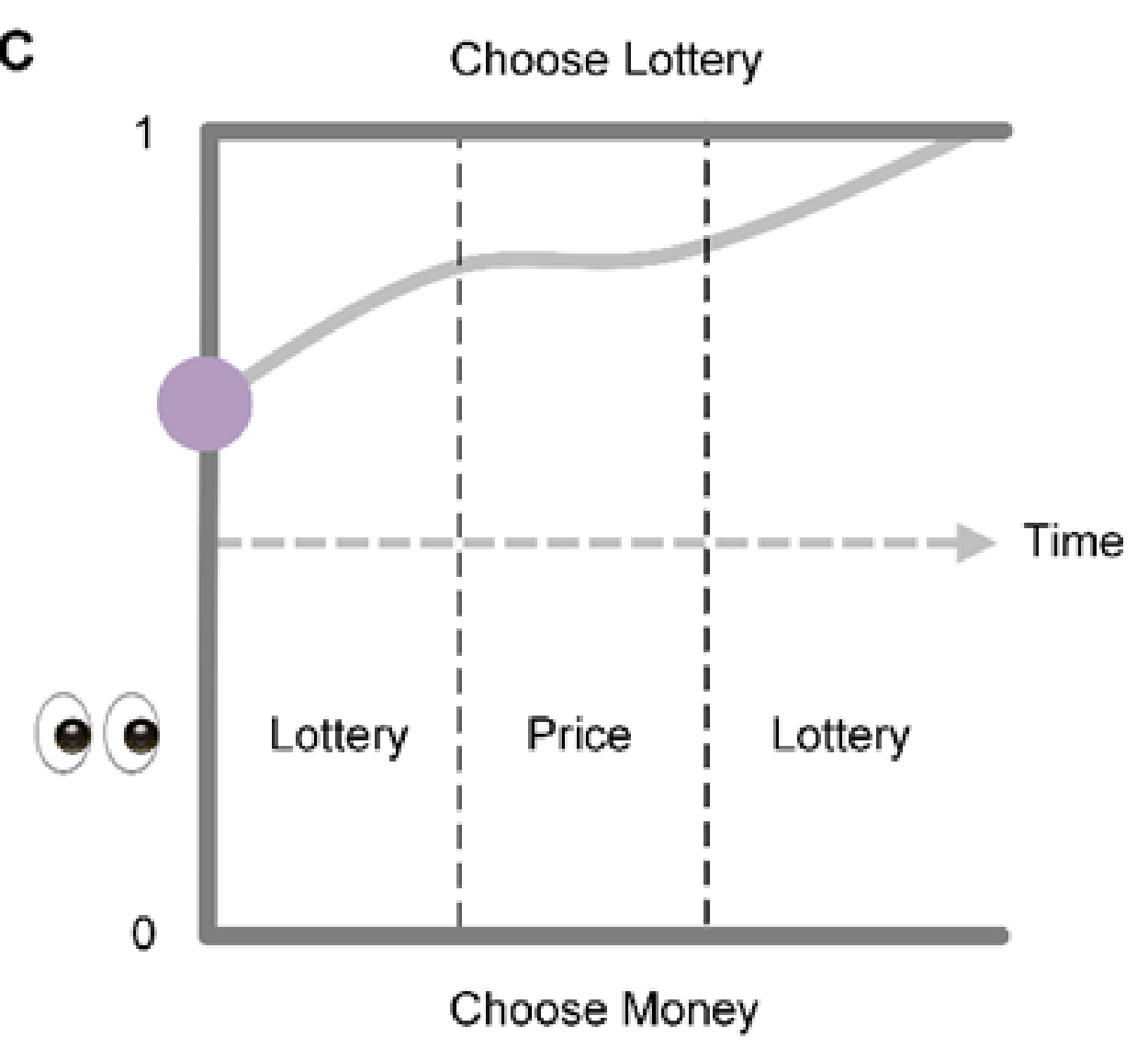

As we all know, decisions are often not made overnight, there is a process. In this process, decision-makers must process and integrate information and then make a choice. The variance in this decision-making process is reflected not only in the decision whether to trade, but also in the time it takes to make the decision. Feng SHENG and his team believe that the choice and time of buyers and sellers in transactions can simultaneously reflect the greed and laziness of buyers and sellers. To test this hypothesis, they recruited a group of subjects to conduct trading experiments. In the experiment, the subjects acted as buyers or sellers and traded a specific commodity - lottery tickets. Each lottery ticket is assigned a certain probability of being exchanged for a certain amount of money, i.e., each lottery ticket has a certain expected value. Buyers and sellers must decide whether to buy" or "sell " their lottery tickets with different face values (green field below) at different prices (blue field below). |

|

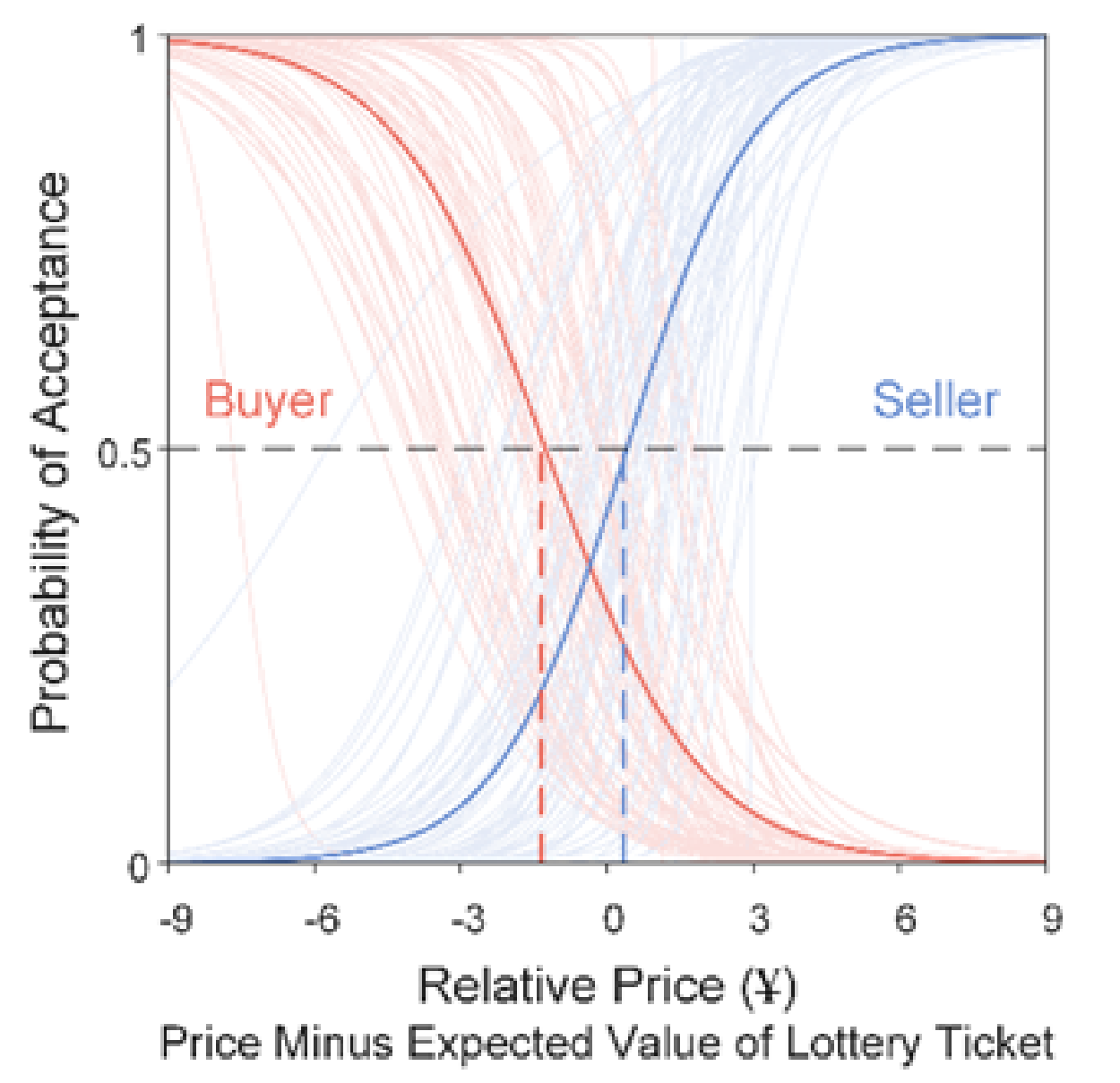

As the experimental results show, the higher the price, the lower the probability that the buyer chooses to buy a lottery ticket (red line below) and the higher the probability that the seller chooses to sell (blue line below). The price for the 50% probability of buying or selling reflects the psychological price of the buyer or seller. |

Based on this norm, Feng SHENG and his team found that the psychological price of sellers (the intersection of the blue line and the dotted line above) is higher than that of buyers (the intersection of the red line and the dotted line above).

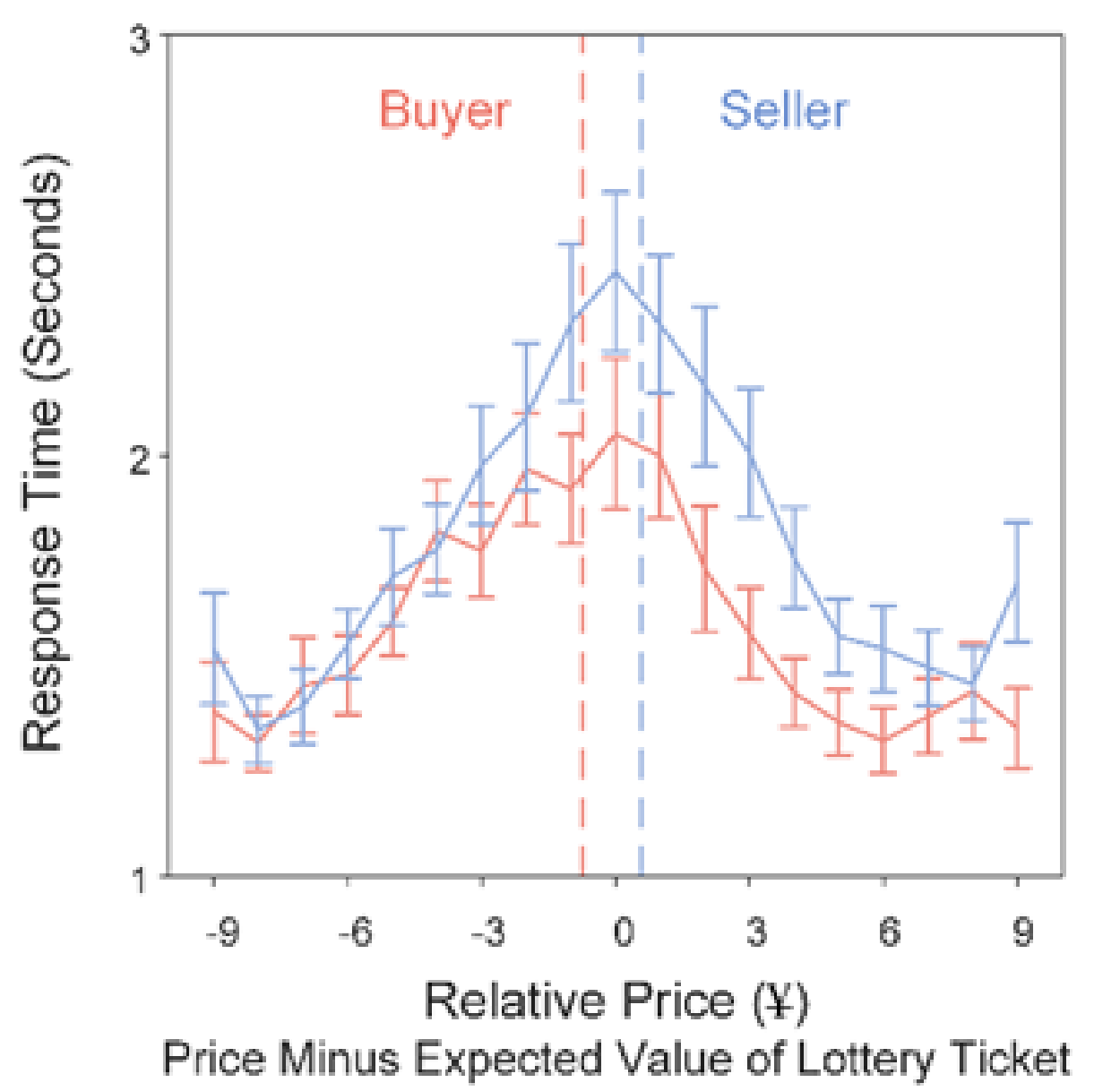

When the price of a lottery ticket rises, the time it takes buyers (red line below) and sellers (blue line below) to make a decision takes the form of an "inverted U".

Feng SHENG and his team therefore make a reasonable assumption: The most difficult time for buyers and sellers (i.e., the longest time) is when the price is close to their psychological price.

Based on this norm, they again found that the psychological price of sellers (dashed blue line above) is higher than that of buyers (dashed red line above).

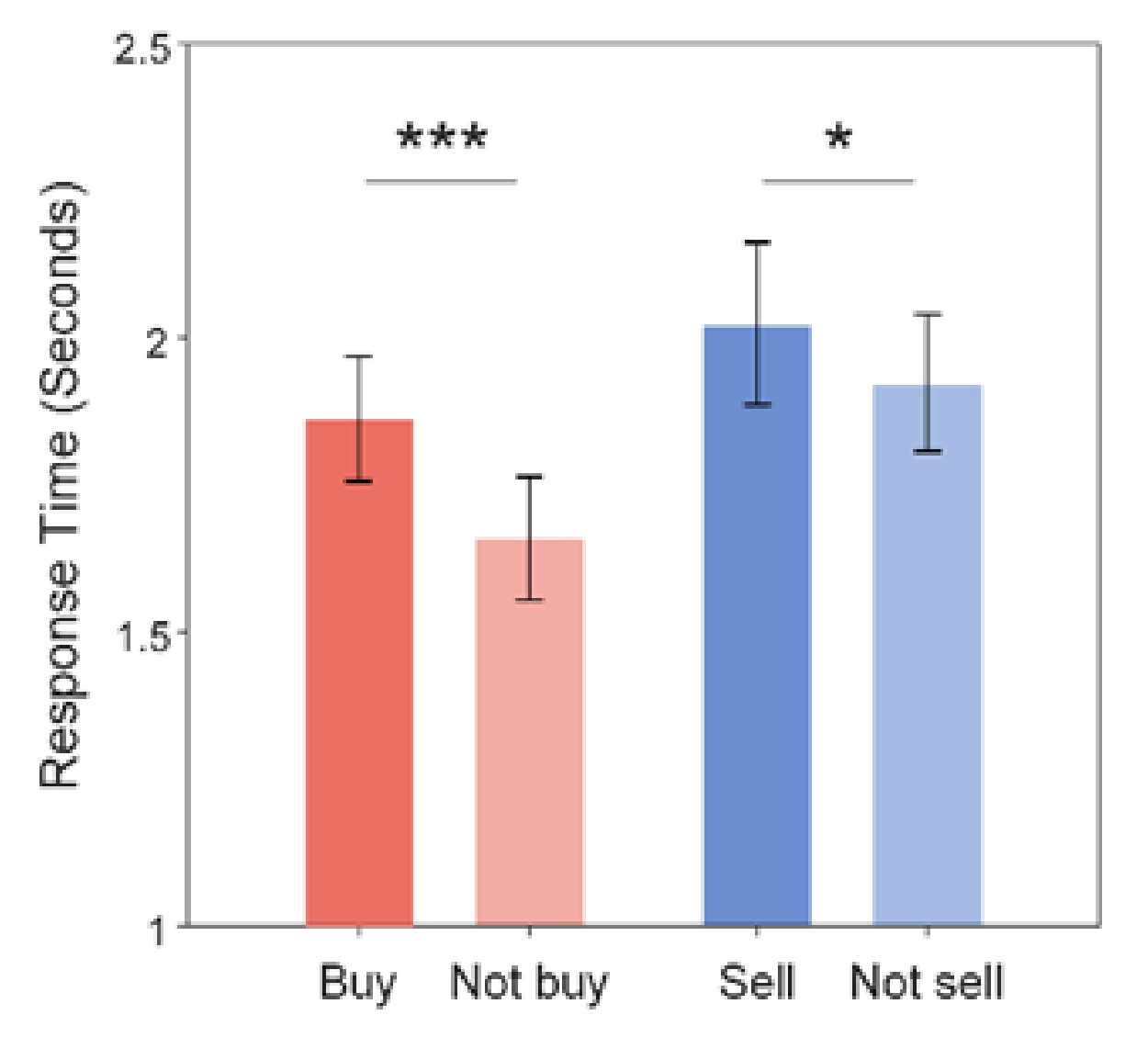

The results also show that buyers buy more slowly than they do not buy, while sellers sell more slowly than they do not sell.

This shows to some extent that both buyers and sellers have the inertia not to trade. On the contrary, the decision to trade requires more effort than the decision not to trade.

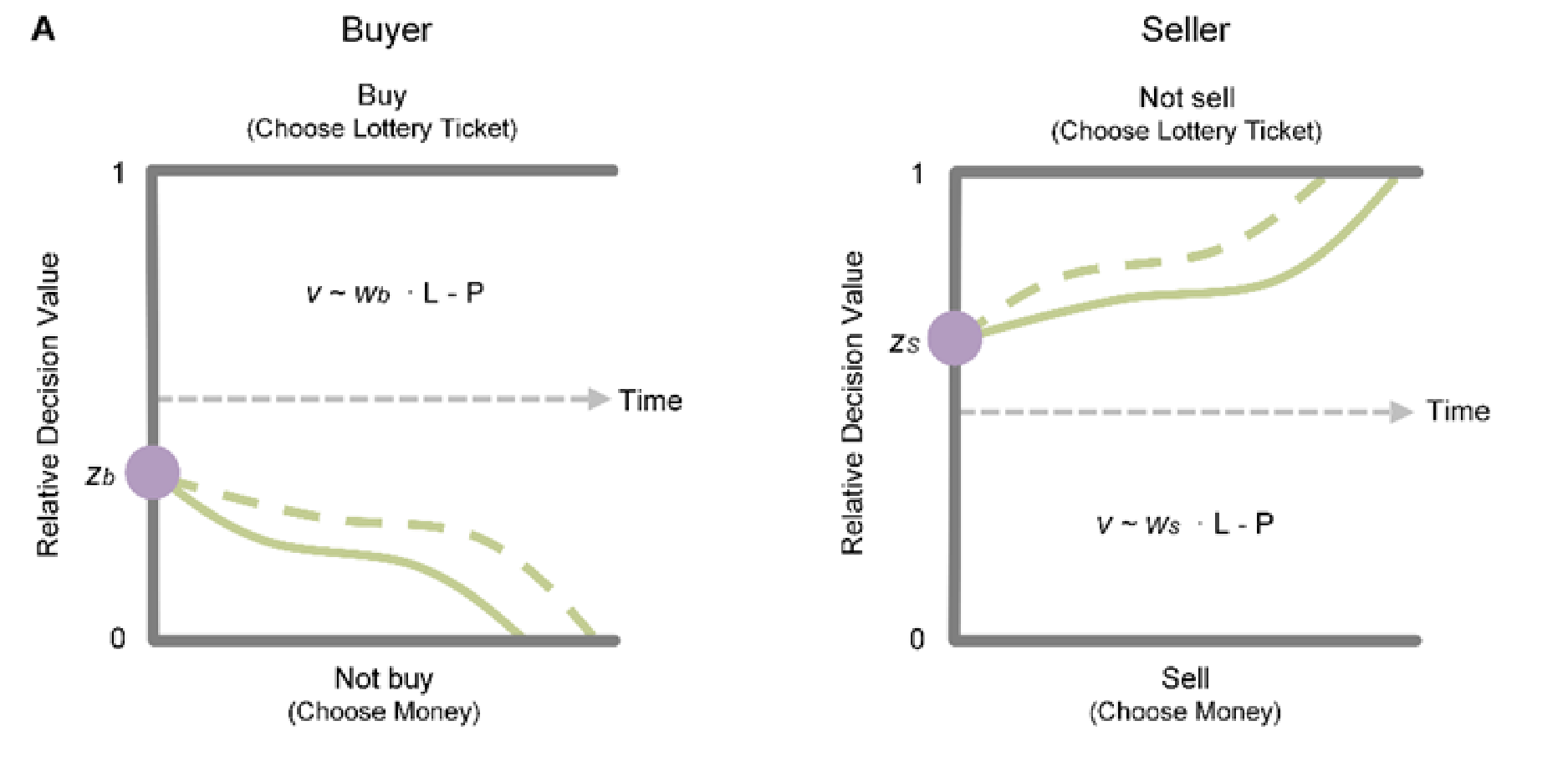

To integrate the observed information about choice and choice time, Feng SHENG and his team proposed a model for the decision process in trading based on the Drift-Diffusion model.

They view the decision "to buy or not to buy" and "to sell or not to sell" as a process of evidence accumulation.

In particular, "greed" influences the weighting of the various pieces of evidence, e.g., buyers underestimate the value of goods, while sellers overestimate the value of goods. "Laziness" affects the amount of evidence required. For example, buyers need more evidence to decide in favor of a purchase than against a purchase, while sellers need more evidence to decide in favor of a sale than against a sale.

On this basis, they have integrated "greed" and "laziness" into a model for trading decisions.

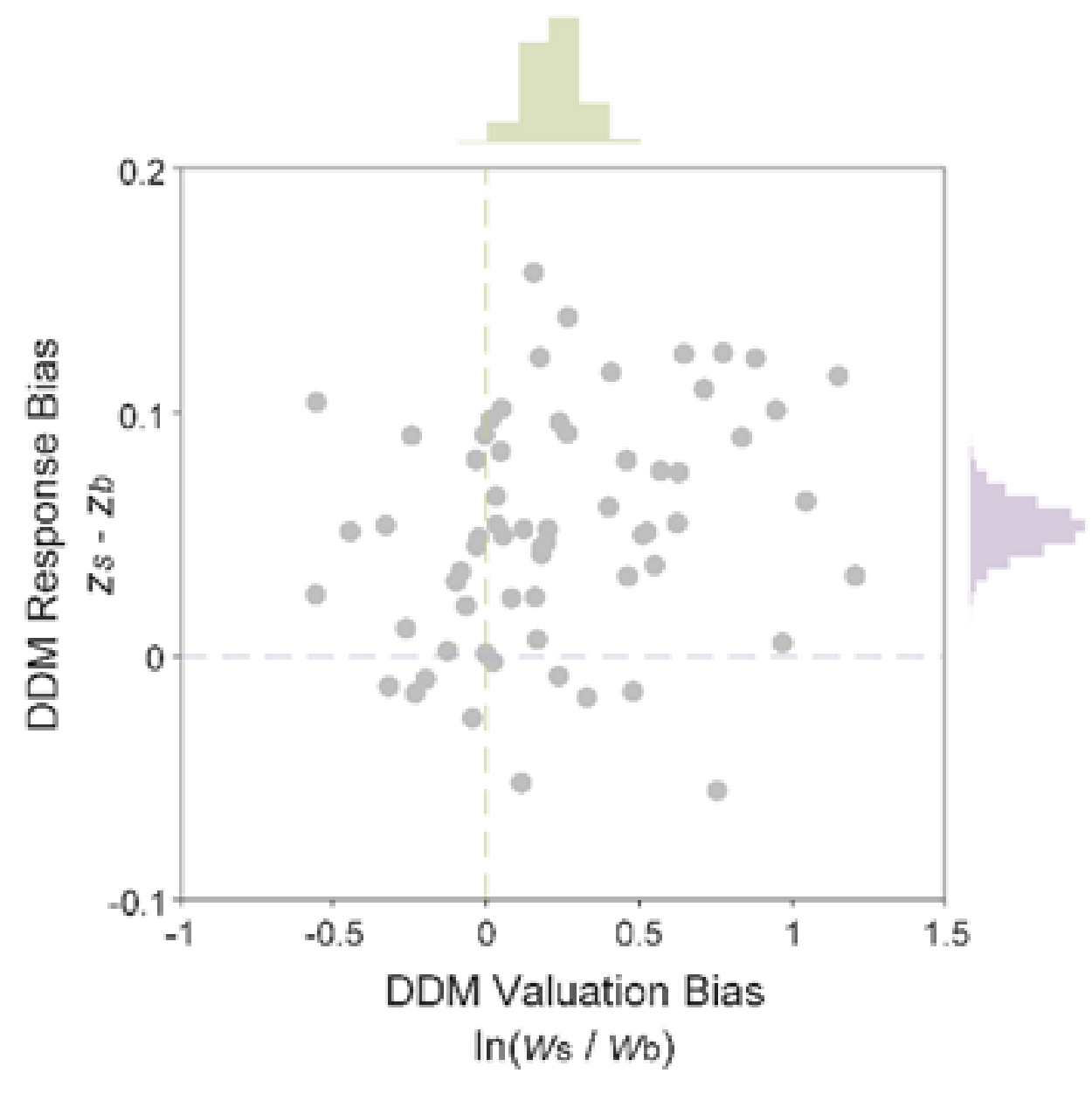

Then they use this computational model to adjust the decisions of buyers and sellers and the time at which they make their decisions to identify the different degrees of greed and laziness of individuals in the transaction.

The results show that there are obvious individual differences in quantity. Some people mainly show greed in trading, while others show laziness in trading.

|

By Tracking the "Eye Movements" of Buyers and Sellers, They Discovered the Secret Behind Trading |

Combining with eye-tracking technology, Feng SHENG and his team further analyzed the relationship between the "eye movements of buyers and sellers" and "greed and laziness in transactions" and finally found an interesting result of double separation.

|

01 |

The Distribution of Attention Reflects the "Greed" of Traders |

|

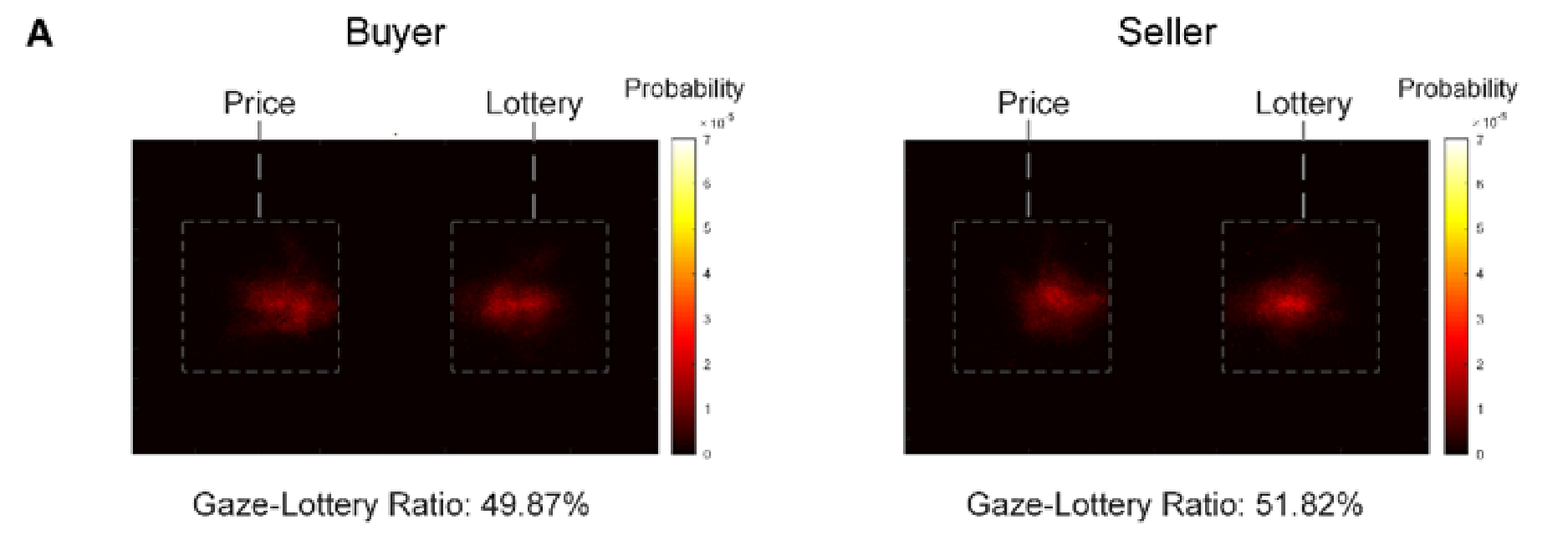

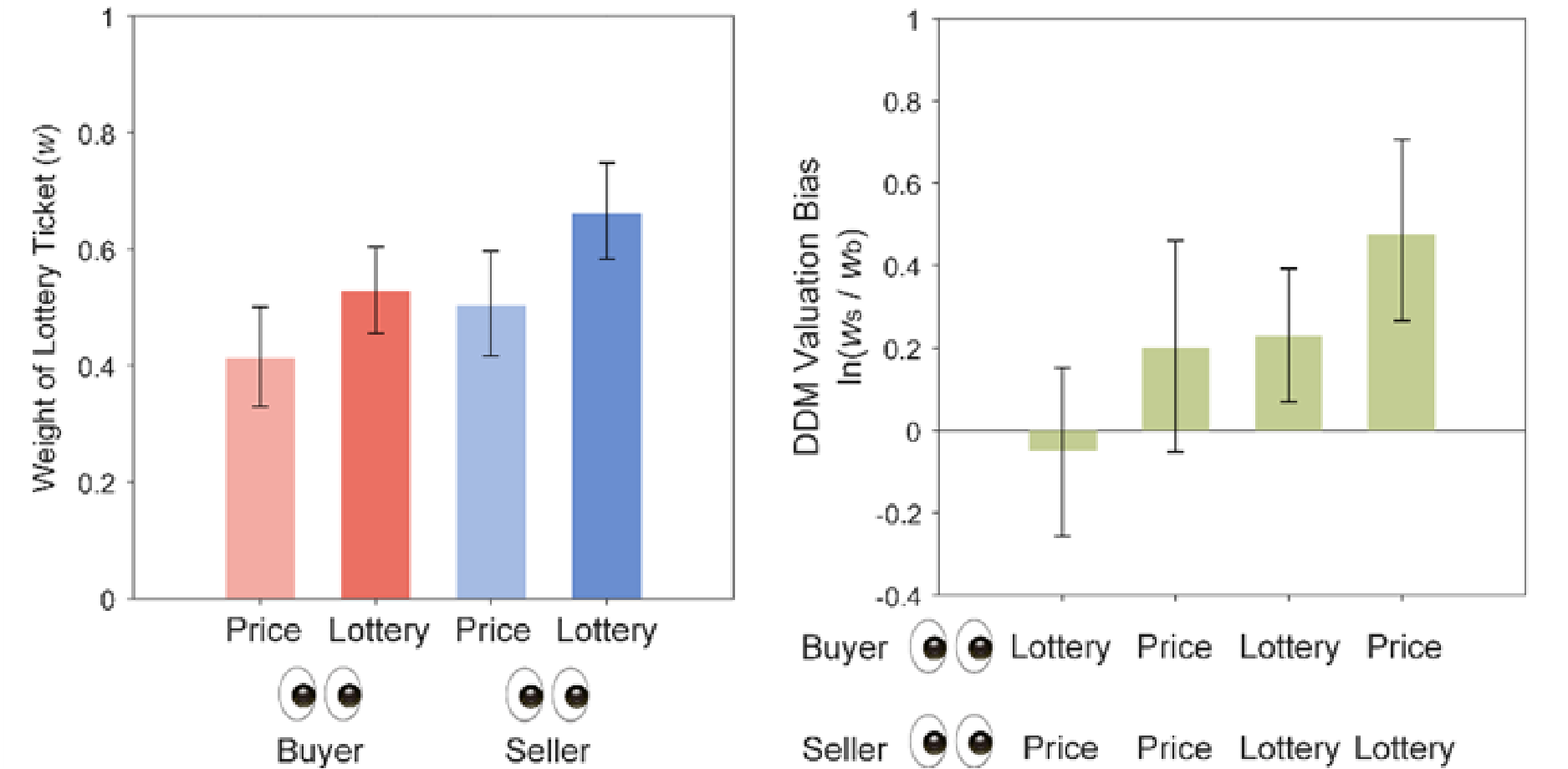

They found that "greed" manifests itself in the attention distribution of buyers and sellers during the transaction process. Previous studies have shown that the allocation of attention not only reflects people’s preferences but also responds to people’s preferences. When making decisions, people tend to pay more attention to the information that is important to them, and the degree of attention to the information they perceive is further enhanced. Feng SHENG and his team found that buyers and sellers repeatedly search for prices and goods with their eyes when making retail decisions. The difference is that sellers pay more attention to the goods than buyers. Moreover, the difference in their attention to goods is simply related to the difference in their subjective evaluation of goods. |

|

In the research, Feng SHENG and his team also integrated the attention distribution into their calculation model to describe the dynamic changes of sellers’ and buyers’ evaluations of goods with the attention distribution. Specifically, the new model assumes that their ratings increase when buyers or sellers pay attention to goods, and that their ratings decrease when they pay attention to prices. |

|

This model, which integrates attention, better explains the behavior of buyers and sellers. Moreover, the research results are consistent with the hypothesis that buyers and sellers rate goods more when they pay attention to them than when they pay attention to their prices (left). |

|

Based on this finding, they have uncovered another interesting phenomenon (top right): • When buyers pay attention to the price and sellers pay attention to the goods, the difference between their valuations of the goods is the greatest and it is the most difficult to make a deal; • When buyers pay attention to the goods and sellers pay attention to the price, the difference between their valuations of the goods is the smallest and it is easiest to make a deal. |

|

02 |

The Study Changes Reflect the "Laziness" of Traders |

|

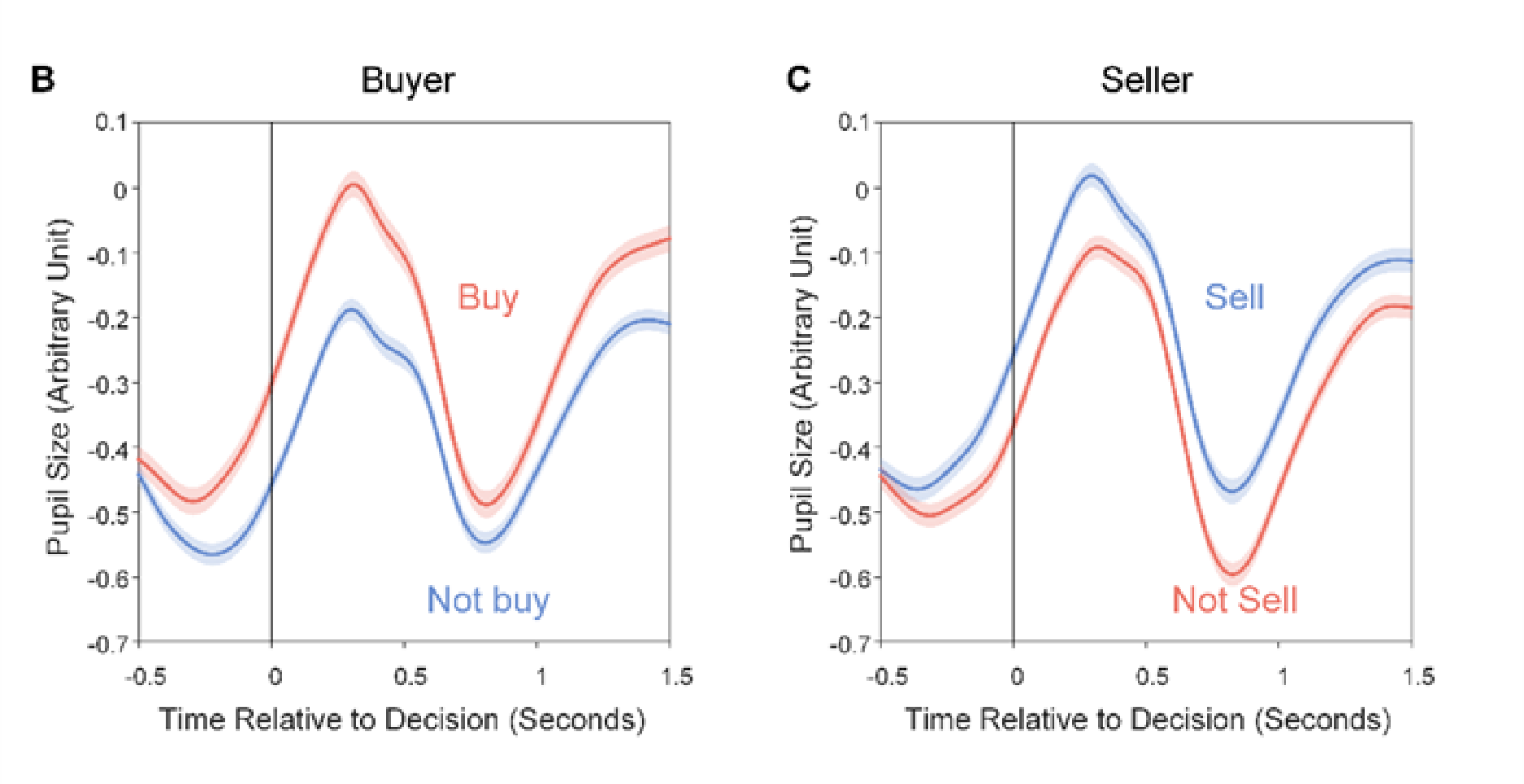

In addition to the distribution of attention, Feng SHENG and his team also found that "laziness" is related to the change in eye-pupil size of buyers and sellers in the transactions. As we all know, the degree of pupil dilation in the decision-making process often reflects the degree of brain utilization. The more difficult it is to make a decision, the larger the pupils are. |

|

According to Feng SHENG and his team’s calculation model, buyers need to collect more evidence when they decide to buy than when they decide not to buy, so buyers should have larger pupils when they decide to buy. Similarly, sellers need to gather more evidence when they decide to sell than when they decide not to sell, so sellers should have larger pupils when they decide to sell. The research results are consistent with the hypotheses: • When buyers choose to buy, their pupils are more dilated than when they choose not to buy; when sellers choose to sell, their pupils are more dilated than when they choose not to sell. At the same time, the extent of pupil dilation in buyers and sellers who decide to buy, or sell is related to their inertia of the status quo attitude. The greater the inertia, the larger the pupil when they decide to trade to overcome the inertia, which means they have made more effort. |

|

This Study Will Provide Important Insights for Trading Theory and Practice Development |

In the digital age of information overload, attention scarcity has become increasingly prominent, giving rise to the controversial "eyeball economy".

Although all kinds of online trading platforms have made great efforts to formulate various mechanism rules to guide and standardize the attention of buyers and sellers and facilitate transactions, a scientific model to represent the action mechanism of attention in transactions is still lacking.

With this in mind, Feng SHENG and his team, with the support of the National Natural Science Foundation of China and the Sci-Tech Innovation 2030 Agenda Brain and Brain-like Research Major Program, conducted this study thoroughly. Their findings will be of great significance and insightful for the development of the theory and practice of trading.

|

©千库网 | Qianku Network |

|

The study covers the following aspects: |

|

01 |

This study provides an integrated theoretical framework for the cause of the endowment effect in transactions |

|

Previous studies on the endowment effect often focus only on the greed or laziness of buyers and sellers and do not sort out the relationship between them. This study introduces an innovative process model for retail decision-making that organically integrates greed and laziness in transactions into a computational framework. Based on this computational model, we can identify different types of trading individuals and quantitatively distinguish the different contributions of greed and laziness to the endowment effect. |

|

02 |

This study provides a normative explanation for the mechanism of attention in transactions |

|

Attention to goods not only reflects but also influences the valuation of goods by buyers and sellers. It is easiest to make a deal when the buyer is concerned about the commodity and the seller is concerned about the price, i.e., when both parties are concerned about what they can get in the transaction. It is most difficult to make a deal when the buyer is concerned about the price and the seller is concerned about the goods, i.e., when both parties are concerned about what they might lose in the transaction. |

|

©千库网 | Qianku Network |

|

03 |

This study shows the link between the change in pupil size and the success of transactions |

|

Previous studies on transactions rarely consider changes in the pupils of both parties. Based on the relationship between pupil change and inertia, this study found for the first time that a transaction is most likely to be completed when the pupils of both parties are dilated. |

|

04 |

This study provides theoretical clues for optimizing the trading environment |

|

The theory of this study is to promote the transaction, it is necessary to combat the greed and laziness of both parties. To combat "greed", we can draw the attention of both parties to the transaction, i.e., we can make the buyers pay attention to the goods and the sellers pay attention to the prices. To deal with "laziness", we can reduce the effort required for the transaction, e.g., by making agreeing to trade (buying or selling) the default option in the trading system. |

|

©千库网 | Qianku Network |

In general, this study shows that if both parties to the transaction care about their gains rather than their losses and both parties’ pupils dilate at the same time, a deal will materialize, which is the "art of the transaction".

- You can read the original article in Chinese here